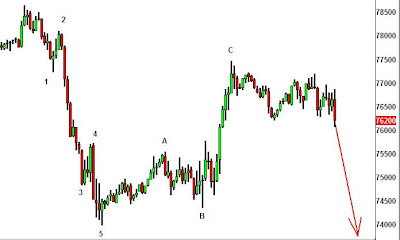

Attached is a daily S&P futures chart showing the huge 5 wave decline that started more than 1 1/2 years ago. With new lows in the S&P and Dow in place, the decline can be considered complete, and at any time a huge multi-month rally that will correct this decline (at a minimum) will be underway. Obviously considering how large and long this decline was, the ensuing rally will be absolutely insane and breath taking. I'd like to catch the majority of it if I can keep risk tight, which might be very hard to do. This rally should last most of 2009.

As for the short term, as I've said in the last few posts I in no way want to get caught naked short now. The market has satisfied all of EWP's requirements for a 5th and final way and can rally huge at any time. I have a 1/4 short position in the Nasdaq 100 protected by call options in place. So if I miss the bottom, the call options will minimize the damage significantly. But looking at two things 3 things it appears the decline is not complete:

1) the Nasdaqs have not broken their 2008 lows, but should do so before this decline ends.

2) the wave structure appears incomplete as I'd like to see a small wave iv and then a wave v to complete it. This would fit into having the Nasdaqs make new lows as well.

3) after a huge 1 1/2 historical decline, I can't imagine a soft bottom be put in this market. I picture a huge selloff starting in oversold territory where almost all traders literally throw in the towel and sell, pushing this market down anywhere from 3%-6% in a day. Then a huge rally ensues from that into positive territory. That is when basically all the sellers have sold and only buyers are left to launch this market to the moon. We haven't had that yet.

So there it is. I'm very very cautiously bearish, waiting for signs of a bottom to get aggressively long.