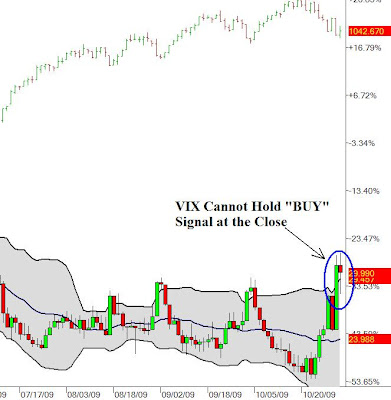

A quick note, the S&P cash is bumping against the daily ascending trendline I've mentioned here a few times. This is typical behavior after the break of such a significant trendline in that there's usually a retest of the underside before reversing again. When you add what I said about other resistance levels this morning, the S&P is in a perfect place to top soon.

It seems that traders are taking the day off, maybe a lot of folks are getting Monday off for the holiday and left town early. But volume is low and we've basically been flat all day. There might be a short covering rally at the end of the day if this continues because the bears usually don't want to go into a weekend holding their short positions.

So there's no strong evidence of a top, but the market is currently at levels that would market nice reversal points.