It was a very busy day today as I close most of my options today at nice profits and moved into new positions. Here is a summary of options trades closed this week:

HMY +17%

BKH +40%

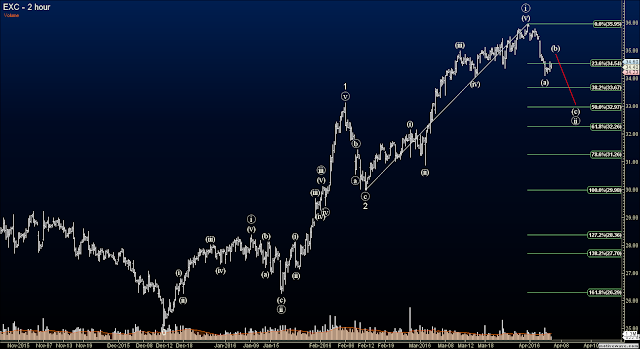

EXC +42%

EIX +30%

T +25%

SYY +39%

I already detailed the trade setups and closures of the closed trades, so I'm going to briefly show my charts and trades for my new positions today:

Arrow Electronics (ARW) fired off a bearish signal several days ago but didn't confirm it until today's decline which tells me wave ((c)) of 4 is getting underway. If so, I want in on it. Now, earnings are next week which could bode well for my trade, but I am unsure how it will play out so I want to be cautious here. I'm going in only at half a position and am moving out the options to June. This way if the earnings response results in a sharp rally, I can add another half position short and be able to wait it out until June:

Bought HALF position ARW put vertical at 57.5/65 for $2.35

Domino's Pizza (DPZ) fired off a short signal over a week ago but it was not confirmed until today as a mature wave 5 of (5) appears to have completed. This is in a similar position as ARW in that earnings is going to be announced in 7 days so I want to allow for an earnings spike higher and be able to add to the position and have enough time. So I'm only going in half a position on the June options:

Bought HALF position DPZ put vertical at 125/140 for $5.20

I've been watching Children's Place Inc. (PLCE) for several weeks and there have been sporadic bearish signals the past two weeks but no confirmations. My patience paid off as you can see that the past couple weeks this stock as rallied sharply in wave B. But I think this might be a good opportunity to start getting short this stock as price close right on the bearish signal confirmation line, wave A looks like like a 5 wave impulsive move so it is unlikely to be in a "Flat Correction" which would take wave B above $84.91 (in Flat Corrections, wave A is three waves). Also, earnings are out in 3 weeks and I want to start getting short cautiously. So I'm doing half a position in June options:

Bought HALF position PLCE put vertical at 72.5/82.5 for $3.32

Motorola Inc. (MSI) fired off a bearish signal the end of March, it was not confirmed, and then continued to rally. The past week there have been consecutive bearish signals in place that has finally led to a confirmation at today's close. The wave count suggests a sharp wave 2 down may be getting underway now. Earnings are in 2 weeks but the price action, signal and wave count line up well here to get fully short:

Bought MSI put vertical at 67.5/75 for $2.24

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.