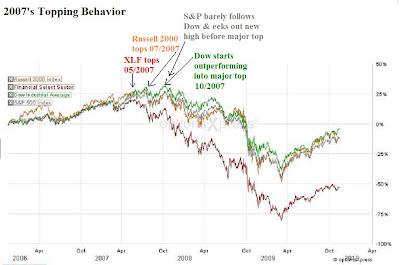

I think it's important to illustrate with charts my thesis about how important it is that the Dow is surging higher to new highs while other indices and sectors are lagging behind. Let's study the two index/sector comparision charts attached:

First, look at the structure of these markets during the 2007 topping process. Notice that the XLF made its 2007 top in May, the Russell 2000 made its top in July, and the Dow and S&P topped in October. So the XLF and Russell started their bear market declines months before the Dow and S&P did. Then, also notice that prior to these tops, all the markets were running up quite closely together as you can see how bunched up they were at that time. But then the XLF falls off and separates in May, then the Russell peels away in July, and then the Dow surges higher to new highs separating higher, dragging the S&P along with it until finally they all give way and start their big bear market declines in October.

Second, now look at the current 1 month chart of the same markets. This time the Russell 2000 topped in September, the XLF topped in October, and they are again lagging badly from the S&P and Dow. In addition to that, the Dow is surging higher again, separating even further from the XLF and Russell just as it did into the 2007 top. So you can see that the stock market's behavior today, is similar to its behavior in 2007 when formed a major top that led to the largest selloff since the Great Depression.

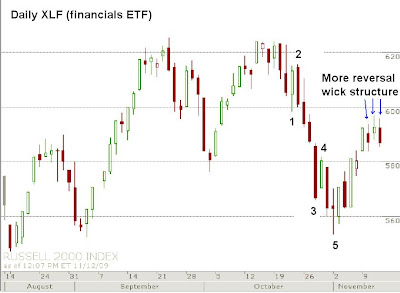

Lastly, another piece of evidence that the Russell 2000 and XLF have topped is their wave counts and structure. Look at the 30min XLF chart attached. It clearly declined in 5 waves from its October high, is sporting a classic topping head and shoulders pattern (not shown), and after its intial 5 wave decline it made a 3 wave rally which is corrective and counter trend. Following that 3 wave rally labeled a-b-c of (2), we now have a 5 wave decline from the wave (2) high, suggesting that the XLF is starting its next leg down. The count and structure is similar in the Russell 2000.

So it seems clear to me that the market is in a major topping process as long as the highs in the Russell 2000 and XLF hold, and is sporting similar behavior to its 2007 top. In 2007, the XLF topped about 5 months prior to the S&P and the Russell topped 3 months prior. So it's possible this may happen again now, meaning the S&P won't top until December 2009 to February 2010. Although I'm not sure this market has enough strength to get that high at this point, and the forces of wave 3 or C will be quite stronger than the 2007 top.

Since the XLF and Russell 2000 are leading the way, I'll be watching them to hint that wave 3 or C in the S&P is underway. I'm looking for a break of the Russell and XLF's November 2nd's lows to signal the next round of selling and that I can try again to call "the top". If Monday morning we get a nice rally again to new S&P/Dow highs, I will probably close my short term call option positions at a profit and sit only on my long term put option positions (QQQQ, XLF, IWM, SPY, SLV) because short term behavior and structure suggests another declining phase fast approaching, especially because volume has been absolutely dissipating on the recent rally leg.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.