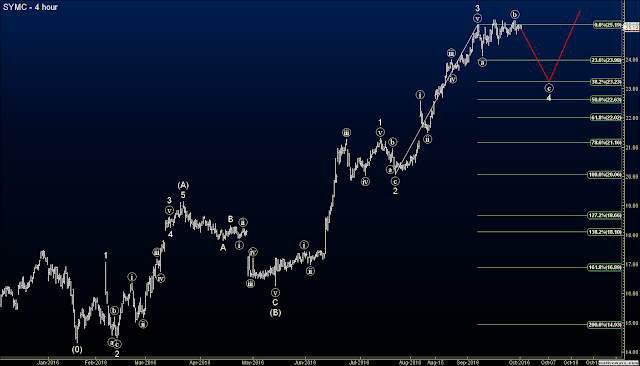

Symantec (SYMC) has been on a tear for a long time, but after Minor wave 3, we see some choppy and weak rising off the wave ((a)) low. This is a topping structure and indicative of a ((b)) wave. Once complete, a sharp wave ((c)) down should take place, pulling prices to the $22.60 - $24.00 range to complete Minor wave 4. So I'm hitting it short with a put spread that will cover earnings postings early November:

Buy SYMC Nov 18 23/26 put spread at $1.19

__________________

On flipside, Stericycle Inc (SRCL) appears to have completed an Intermediate A-B-C correction to the downside. After a sharp gap lower, the stock has trickled down to new lows but not in a convincing fashion. Downside momentum appears to have become exhausted and a possible inverse head and shoulders pattern may be forming. A long signal triggered on my custom indicators so I'm hitting it long here with a call spread to target a confluence of Fibonacci retracement levels of wave (C) and the entire A-B-C move at the $95 area. Here is the trade:

Buy SRCL Nov 18 75/90 call spread at $6.24

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.