I said in my last post that when a market unfolds too perfectly, it usually is not accurate. This by no means is a pat on the back for myself as I lost money on the trade anyway. The market is exhibiting typical wave 2 characteristics in that:

1) the wave is very sharp and strong; and

2) it's accompanying a social mood that the worst is over and a new bull market has begun.

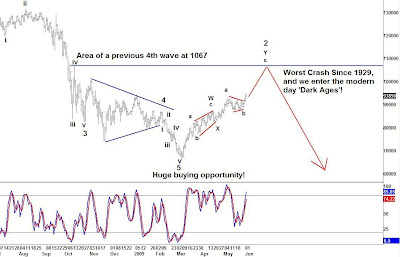

I had to readjust my daily S&P futures chart to update the projected wave count and path in the coming days. The fact that this rally has only corrected with sideways movements, and small dips tells me that it's quite possible the rally will end sooner than I expected at the end of this year. With the current wave count and sentiment reaching a bullish extreme almost matching that of the bullish extreme met October 2007 when the market toped, it tells me I have to be on high alert for wave 2 to complete and a huge devastating wave 3 down to unfold at any time. Perhaps even by next week! I'm watching closely and will update my blog with any significant changes or important information I obtain. Until then, I expect the market to grind higher toward my target of 1067 in the S&P futures.

Here's a question someone posted to me on the blog that I want to respond to:

Do you think it is possible we are in wave 1 of bull market? Perhaps October crash was wave 3 followed by wave 4 up in Jan and Wave 5 down in March? If you say we are in wave 2 pending wave 3 and wave 3 is longer than wave 1 then we are headed to 100 on the S&P ?

Of course it's possible this is the first wave of a bull market. Nothing is certain. However I think this is a very low probability for several reasons. The most important being that: 1) the rally has been done in overlapping waves that cannot be counted as an impulse wave under EWP which would open the door to a new uptrend starting now; 2) bullish sentiment indicators are almost at the same levels reached at the market top of October 2007, yet today the S&P is over 600 points lower. I can't see a new bull market starting with almost 90% bulls out there and the S&P being only at 950. That's the sign of a major top forming again, not the beginning of S&P 2000; and 3) The EWP I have on the entire bear market decline from October 2007 is a very nice and clear 5 waves down (see "Long Term Stock Market Chart" on the top right side of this blog). With 5 waves down it means that new lows must be achieved to finish the pattern. That 5 waves down has to be either an A wave which means the rally is a B wave, and a C wave will bring us to new lows. Or, the 5 wave decline since October 2007 is a wave 1 which means a wave 3 will come next bringing us to new lows. Either way, the March 2009 lows will be broken, and whether it's a C or 3 wave, both waves are very destructive in their composition according to EWP.

As for the length of wave 3. Yes, you are correct that wave 3 must be longer than wave 1 and it will bring the S&P into the 100s or lower. This is correct, and it is likely to happen with the credit deflation scenario unfolding. When you deal with percentages of declines, not point declines, it will put it into better perspective then. The S&P should be well below 100, and the Dow in the hundreds, by the time this bear market is over. Hard to believe, but that's what the evidence strongly suggests.

2 comments:

Is there a timeframe that needs to be met for a P2 wave ? If P1 was 17 months how long would P2 have to be to qualify? Also if you could identify a target on the downside for DOW/S&P as well as a timeframe for P3 to play out that would be helpful. If for example P2 ends this summer and P3 has to be longer in length than P1 does it also have to be longer in terms of time ? If so then would P3 have to be longer than 17 months to the bottom ? Thanks!

There´s possibility this is W2. In fx market everything seems to fit for corrective structure also.

Eurodollar starts to get some exiciting moments in here (skip that rising wedge chart and take a look daily chart fib lines, at least there´s sideways triangle top soon in the air)

http://just-charts.blogspot.com/

Post a Comment