Today was a very volatile day, which usually occurs at tops as the bulls and bears fight it out. Today we had good economic data come out and so the Dow soared 145 points as I suggested was possible in my Friday post. But then the market sold off and actually put all the indices into negative territory today and to new lows from last week in the process. This is a sign of trend change; the fact that good news and rallies are being sold indicates the trend has changed to DOWN. NYSE internals were somewhat solid on the rally this morning but by the end of the day they were only slightly positive despite the big surge into the close. Also, the Russell 2000 did not quite make it into positive territory and the Nasdaqs lagged as well but ended slightly positive. All-in-all, a bearish day in my view. If I were a bull, I'd be very concerned with today's action. On the surface there were great earnings and forecasts the past few weeks, a good GDP number, and today held great economic data as well, yet the market could barely hold onto early gains and actually broke last week's low. That's bearish.

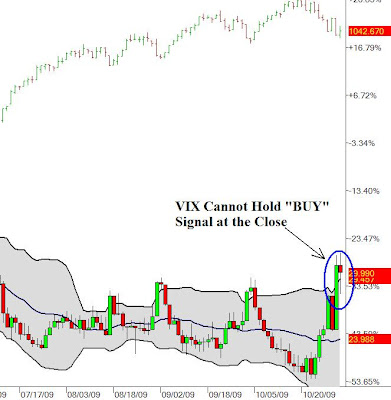

The VIX did not close beneath the upper bollinger band today as you can see on the attached chart, so there's no bullish signal from that area yet.

Also, the all important dollar did a big reversal and rally today after a pretty solid selloff from last night. The decline was left as a clear 3 wave drop, that we can see after the rally today, and that rally was done in a clear impulsive manner (5 waves, which means the trend is up now) as I posted earlier today. Above is an updated 1hr dollar chart and wave count and shows significantly bullish potential in the near future with a wave (iii) of 3 getting started. This should be a very powerful rally and should put significant pressure on stocks in the process.

Any rallying from here that stays beneath 1101 in the S&P cash is a great opportunity for the bears to get short in my view. I would be selling rallies, and definitely not looking for any long positions to buy at all at any timeframe at this point. Also keep in mind that the Fed announcement is this week along with unemployment numbers and these two events tend to bring about a lot of volatility.

2 comments:

nice point about the vix, thanks todd

volatile, volatile, whew!

Yeah, the VIX appears to have "broken out" from its slumber and is showing life, or panic, entering the market again.

Big movements ahead, especially the way the wave count is shaping up and with the Fed announcement and jobs data this week.

Should be a fun week! :-o

Todd

Post a Comment