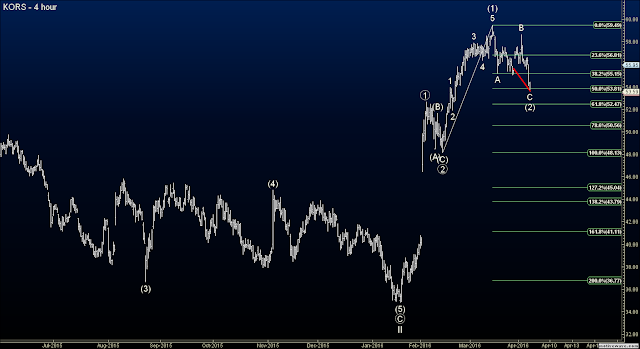

Michael Kors (KORS) had a sharp reversal after wave B completed and is now in a Minor wave C of (2). Overall the trend in this stock is bullish so I don't want to get greedy here. With over 4% down today, and reacing 50% Fibonacci retracement of wave (1), I'm more than happy to take a 31% profit and walk away. Here was the trade:

Entered Put Spread at $1.65 and just closed it at $2.16.

HERE IS THE ORIGINAL TRADE SETUP:

KORS has formed a short term too that should see the retailer drop to at least the $51.50 - $51.75 area before resuming its uptrend. I placed a put spread in for this trade and here are the details:

Sell May 50 Put

Buy May 55.5 Put

Limit price of $1.65 per contract

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.

No comments:

Post a Comment