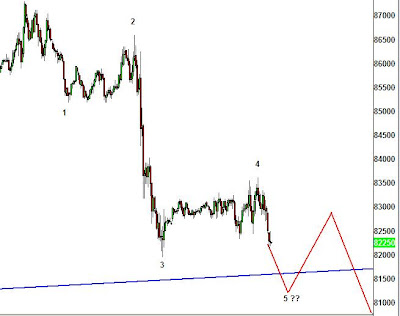

The wave structure is running out of waves 1 and 2 where it now needs to collapse in basically a straight line down in a wave (3) of 3 of (iii) immediately. The choppy decline seen yesterday and Thursday does not fit nicely into a wave count however we've seen this choppy widening downward movement in the past. Right before the October crash the market did the same thing for weeks before it finally made a straight line down that month. So we'll see if that happens again. 841 in the S&P futures needs to hold otherwise we could have a week or so of more rallying. I'm uncertain of the near term so I took half of my positions off and will re-establish them on a rally above 841 or a drop below 804. The fact that the Dow has traded and closed beneath the key 8000 level most of the week is very very encouraging to the bearish case.

Expect wave 3 of 3 of 3 to do a straight line down early Tuesday, if not, it's possible we'll have a sharp rally that lasts a week or two before that happens. But overall, I'm aggressively bearish and there's little doubt at all that the larger trend is down and the bears have control of this market.