Stocks have done nothing the past two days so I wasn't going to even post anything today but the action in the euro demands attention. Looking at today's internals you can see that volume is still declining and overall very light, and that there is a general malaise amongst market participants after the New Year surge. So the New Year kicked off with a typical bullish day, but there's been no follow-through to the rally. That's overall bearish in my view. When volume re-enters, stocks should fall soon afterward, if not immediately.

Why Choose the Wave Principle?

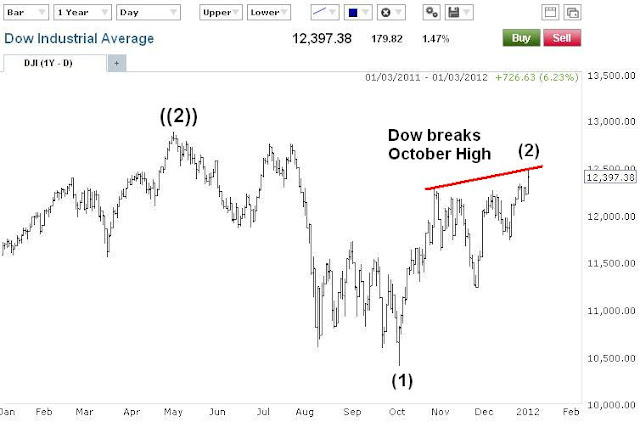

Nothing has changed from my last post, so see my comments and wave count below in the previous post for context of today's thoughts. Stocks have been range bound for a while now, albeit not perfect at all. I don't recommend trading off this since it is quite imperfect, but it is something to watch. On the daily chart you can even see what some call a "pennant", but we wavers call a "triangle". Only it doesn't fit EWP's rules for a triangle so I'm not posting it here. But it's still worth noting that this pennant formation has made it onto CNBC where some analysts have mentioned it looks like we're breaking out to the upside. The contrarian in me would love that. A sharp rally out of the "pennant" would most likely lead to a quick reversal, and probably mark another major top.

Stocks are trying to break out of the range they've been in the past couple months, but will have a hard time doing so without any volume to fuel the move. Like I said above, a sharp rally and reversal would be a welcome sign for the bears to jump in with a clear stop level just above the top of point of reversal. The action in the euro also lends itself to the near term bearish outlook for stocks as well.

Learn Elliott Wave Principle (EWP)

And speaking of the euro, it got a little sneaky the other day as it topped and sold off sharply before I had a chance to get in fully short. I added a small amount to my core short position yesterday around 1.2925, but only about 10% of what I wanted to add altogether. It may be tough to add shorts at this point, but if we're fortunate enough to a big bounce after what appears to be a nice 5 wave decline, I'll be adding shorts ferociously since it looks like another big top in the euro has occurred. And this bearishness also lends itself to the bearish outlook for stocks as well.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.