Yesterday I said the market was oversold and that bears should exercise prudence and caution and wait for rallies to get short. I also added that taking a very small short position late in the rally yesterday would also be wise. And of course, I wish I had gone "all in" yesterday, but that would have been a pure gamble on my part. And I try not to gamble in the markets anymore. The only reason I said that it would be wise to take a small short position yesterday is because sometimes when the market is oversold, and there's a big looming topping pattern in place (head and shoulders), the market will accelerate downward with a massive selloff. But this is rare, so putting on only a small short position seemed wise. Hind sight is 20/20 though, and today's action won't change how I approach the market in the future.

Now I don't want emotions to get ahold of me, I'm in the business of taking well thought out and disciplined strategies that offer a high possibility of success relative to the possibility of failure. So I still want to approach the market smartly here and not get caught up in the "I'm gonna miss the move unless I put everything I own in to short the market now" crowd. With that said, I must say the charts, price action and internals look absolutely horrible right now and it appears that the equity markets are in severe trouble. So finding a good entry point for the bears might be difficult. All I can say that if someone were to have to get short and just can't stand having a small, or no position on right now, then I'd suggest that they make sure that they always keep at least some cash on hand to add to their positions on rallies, and/or to make sure they can survive a huge and sharp snap back rally.

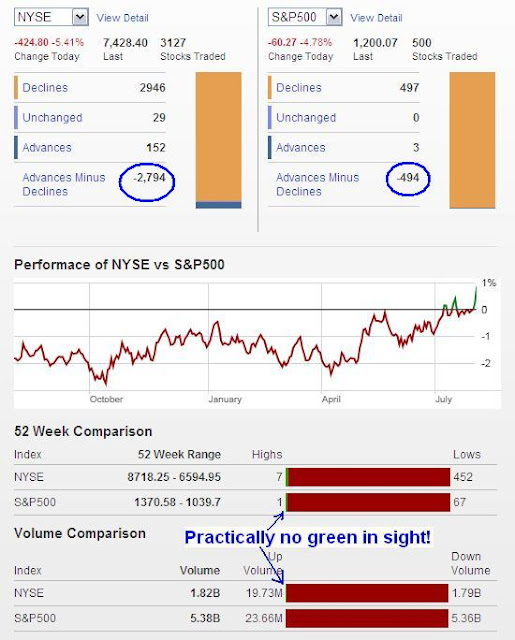

Looking at the internals today it's hard to think that there's anyone left to sell. An amazing 1.82 billion shares were traded on the NYSE today. This is about 1 billion more shares than the average the past few months. Buyers were non-existent as the S&P had only 3 advancers and 497 decliners while the NYSE had only 152 advancers and 2946 decliners. NYSE down volume represented an amazing 98.4% of all trading done today. Those numbers are absolutely incredible in their entirety. Just amazing. But with so much selling force done today in such a calm orderly fashion, it's hard to think that there's anyone else left that's going to sell tomorrow. I mean, who would have waited all day through a slow orderly selloff to -500 on the Dow and then is going to wake up tomorrow and sell? Unless more horrible developments take place in Europe or early in the US session tomorrow that aren't already expected, then I would think we'd at least get a relief rally either early tomorrow morning, or most likely after an initial decline early in the morning where it will bounce back later in the day. BY NO MEANS AM I TRYING TO GET IN LONG AT ALL. I'm merely preparing myself for any rally that I can short into.

Unless the Dow rallies over 500 points tomorrow, this market looks horrible right now and the short side should be favored whenever opportunities arise, in my opinion.

Learn Elliott Wave Principle

For those of you who are savvy in chart technicals know this chart looks very very bad. You have a major head and shoulders topping patter that has completed and has been followed by a very sharp drop to new lows. Today's close occurred on the lows suggesting further selling early tomorrow morning, although I'm not sure who out there missed their selling opportunity today and decides to sell tomorrow after a 500 point drop. But the chart is the chart, and it suggests that as it stands now, this market is in severe trouble. Now that can all change in a heartbeat, like with a 600 point Dow rally Friday. But we trade the with the data we have and view the market as it stands now. And as it stands for the moment, stocks are in big trouble.

|

| Elliott Wave International on today's 500 point Dow drop |

The euro wasted little time taking back yesterday's gains and breaking down to new lows which I said yesterday would mean follow through to the downside. The euro's series of lower highs and lower lows suggests the trend is down, despite no discernable wave pattern to count. Look for the euro to charge for the 1.4000 area soon.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.