This trade did not work out and I was stopped out at a loss of 236 pips (averaged entry) on 2/3 position. This trade is not over and the hourly charts are showing some bullish life so if the 4hr or daily charts trigger another signal, I might try getting long again. But I will be more patient the 2nd time and perhaps buy on strength since when this pair pops higher it will probably be ferocious

ORIGINAL TRADE SETUP:

Adding 1/3 to my current long position now that prices have dropped overnight:

Long now at 1.8747

Added to long position at 1.8646Stop at 1.8460

Profit target at 1.9300

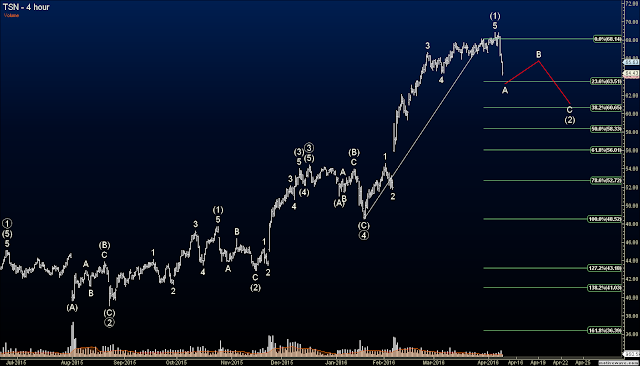

The daily charts fired off a buy signal on my proprietary indicators which is line with a Minor 4th wave rally in the GBPAUD. There has also been long standing bullish divergence on momentum indicators since late February, like in the RSI as shown. This is a large trade so I'm only taking a 1/3 position of my normal position size:

Long now at 1.8747

Stop at 1.8460

Profit target at 1.9300

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.