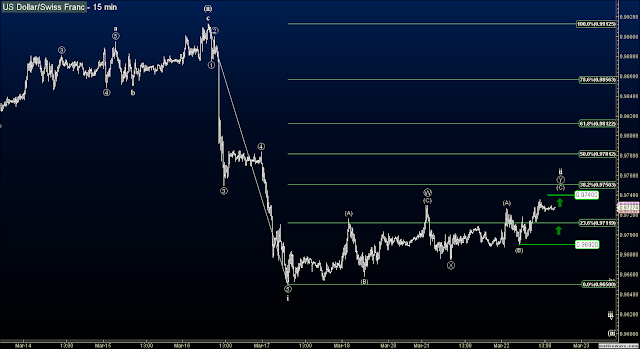

Well, it took long enough, but the Swissy finally grinded higher towards my target at .9740 for a nice 50 pip profit. It came within 5 pips of this and reversed so I'm closing half my position and moving the remainder stop loss to breakeven at .9690. The dollar is poised to continue higher, probably to the .9780-.9800 area before considering to top. But I got my pound of flesh in the market so I'm happy with the trade.

ORIGINAL POST WITH TRADE SETUP FROM MONDAY:

I got a long signal on the 2hr chart on the USDCHF which suggests the correction in the USDCHF is not complete. This makes sense as the correction has not made it to the prior 4th wave, and for a 2nd wave correction it would be quite shallow at the 23% Fibonacci level. So this pair should unfold in a Combination WXY correction higher toward the prior 4th wave and 50% Fibonacci level at 0.9812. Here is my trade:

Entered Long at market at 0.9690

Stop Loss at 0.9645

Profit Target at 0.9740

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.