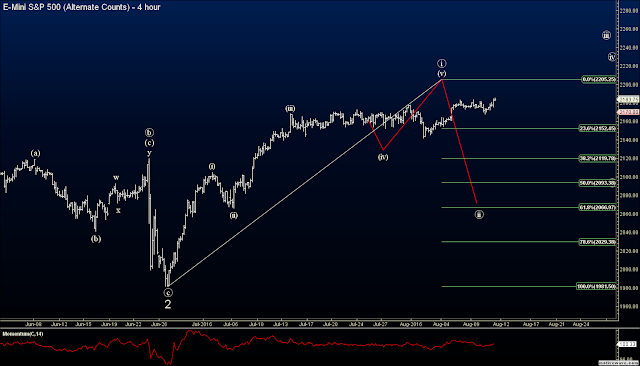

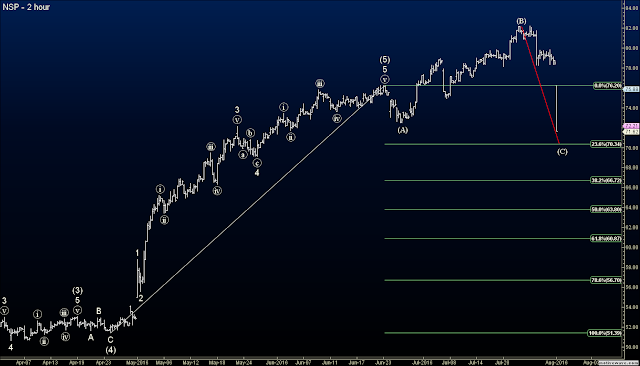

The stock market is just a mess of low volatility and general apathy. I do not want to read too much into the waves or price action with this kind of movement. The summertime lull of trading officially ends after Labor Day so I expect some solid moves to reprice the market to appropriate levels in the days/weeks following Labor Day. So some good moves should occur as September gets underway. Until then, I am focusing on my options trades and the forex trades I detail below.

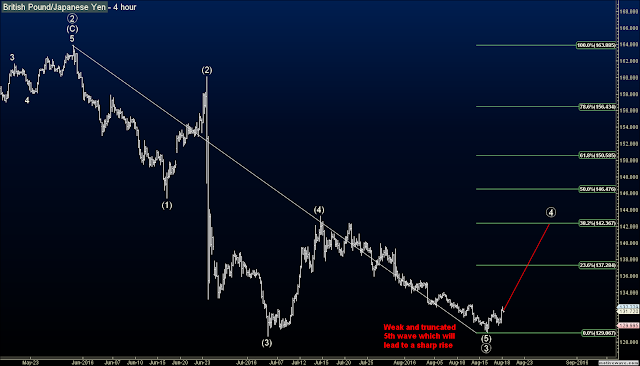

The British pound took off just like I projected, and the GBPJPY and GBPNZD were nice mediums to use to take advantage of this rise. I entered the GBPJPY at 131.72, and it is sitting at 137.00 right now, and since I'm still long the GBPNZD I want to close the GBPJPY now to lock in profits. The GBPJPY has outperformed the GBPNZD so far, and it is at the 23% Fibonacci retracement level, so it's possible it will take a pause here and let the GBPNZD catch up a bit. Here is the result:

GBPJPY entry at 131.72 and close at 137.00 for 528 pip profit.

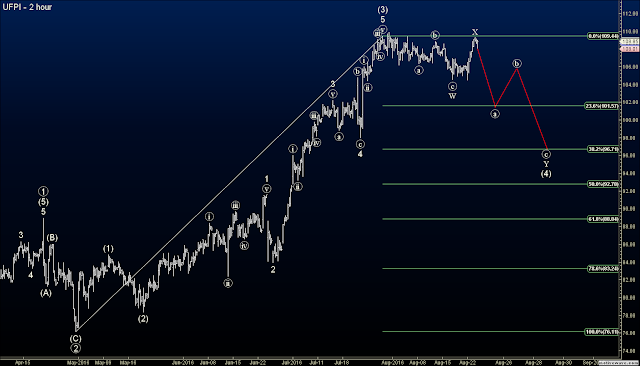

Speaking of the GBPNZD.... the rally is a complete mess, but is trending upward and still has room to move. Fibonacci targets of resistance are at 1.83940 and 1.8549, although I still see hitting the 1.8600 - 1.8700 range before considering a top. I entered long on this trade at 1.8061 and it is currently at 1.8216 so I'm at a respectable 155 pip profit, but don't want this to turn into a losing trade, especially after a nice profit on the GBPJPY. So I'm moving my stop loss here to breakeven:

GBPNZD entry at 1.8061, moving a stop to breakeven at 1.8061

___________________________________________

PREVIOUS POST WITH ORIGINAL TRADE SETUP

The British pound has been getting pounded since Brexit but a bottom has been formed and a sharp rally is near. I have two confirmed buy signals on the daily charts, so a big trade is in order. The pairs with confirmed buy signals are the GBPJPY and the GBPNZD.

GBPJPY entry at 131.72 with profit target of 139.00

GBPNZD entry at 1.8061 with profit target of 1.8800

I only have catastrophic stop losses in for both as I want it to have room to run for the next few days or weeks without constantly getting stopped out from over-trading and overthinking the move higher.

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.