NSP dropped 8% this morning after posting earnings so I closed my short position at a nice profit. NSP ended up dropping over 14% later in the trading day so in hindsight, my closure of this put spread was premature. However, my trading strategy has rules in place for taking profits, and my profit target was hit at 8% drop level this morning, so I took profits then. This profit level I use tends to act as a solid bounce point, sometimes permanent, so over the long run it will make more money to use it. Here is the trade summary:

Sold to close NSP Aug 19 70/80 put spread at $6.25

Bought at $4.13

Profit of $2.12, +51%

__________________

ORIGINAL TRADE SETUP...

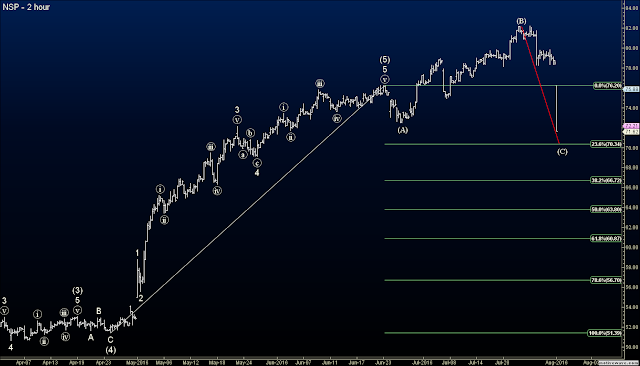

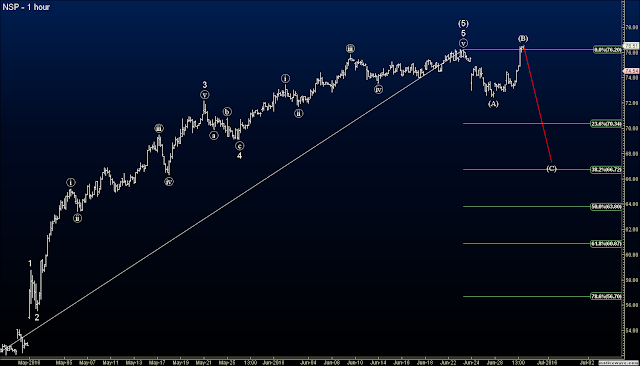

Insperity Inc. (NSP) has been on a huge monster rally the past several weeks but it has become quite choppy and is starting to roll over to the downside. Today's sharp pop is just an exhaustion rally with the tired and tapped out bulls throwing everything they have at it today for one final push. The next move of consequence should be to the downside. I show a large Intermediate "flat correction" unfolding with today's rally part of wave (B) which should soon give way to a strong impulsive decline for wave (C) towards Fibonacci support at the $66.72 level (38% Fibo), which is also near the previous Minor wave 4, another typical draw for larger degree corrections. So I went short with a put spread. Here is the trade:

Buy to open NSP Aug 19 70/80 put spread at $4.13

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.

No comments:

Post a Comment