Just a note for Tues. - Thurs., I'll be on the road for meetings during that time and I'm unsure how much time I'll have for posts during those days but I'll do my best to get the core info I see out to you all during that time.

Well I feel like my name is Mud since I've truly underestimated the potential of this rally. I've been wrong several times in the past few days and I've suffered a lot of trading pain because of it. However, as I said in previous posts when I started getting short again, I wanted to use short term put options because I thought I knew that the market would top and reverse within a short period of time, yet I really wasn't sure where the mak- or-break point was for price. So I bought options to have a set risk amount I was comfortable losing if the market didn't turn. But no one likes to lose and I hate being wrong.

With that said, I still remain bearish for the outlook in the coming days. The market is in a "panic buy" mode in my view and that is the type of behavior I'd expect to see going into a major high, not at the start of a major low being formed after a monster rally that started back in March 2009. If the market had declined 50% and then started to rally with the current structure we see now, I might think more bullish. But within the larger context of the market and the wave count of this monster rally from March 2009, I see this current panic buy behavior as a sharp aggressive move into a top.

Again I'll refer follks to EWI's article regarding the bigger picture of stocks titled

3 Reasons Now is Not the Time to Speculate in Stocks. It helps put things in perspective, especially those long term investment folks who might feel a bit defeated after this rally.

INTERNALS

The internals today were very strong, especially in regards to up volume vs. down volume. Advancers vs. decliners in the NYSE were quite strong but not as much as I'd expect if we were in some kind of wave 3 if we're to assume the market is back in bull mode again. The strength and depth of this rally would suggest that it most likely would be part of a wave 3 at some degree, so I'd expect to see internals that coincide with that. And most importantly, I'd expect to see those stellar numbers in conjuction with high volume, which you can see again stayed well below even the 1 billion share mark. A solid volume number would be in the 1.4 billion or above area. So again, although the few folks participating in the rally are almost all bullish, overall there is little mass market interest on the long side. This is typical of a countertrend move. But unfortunately, that behavior can continue for extended periods of time.

ELLIOTT WAVE PRINCIPLE

Folks trying to trade the ins and outs of this market might find use of EWI's current free resource titled

"Learn How the Wave Principle Can Improve Your Trading". This document discusses entry levels and risk managmeent through appropriate stop levels to the current wave count.

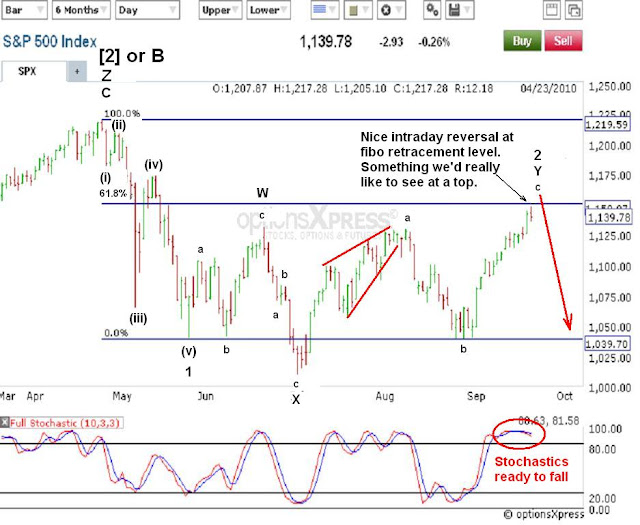

Above is a shot at a wave count that seems to be only real viable bearish option left that would explain the current behavior of the market. Judging by the strength and unrelenting nature of the current rally, I'm assuming it's part of a wave C. According to

EWI's tutorial, "Advancing 'C' waves within upward corrections in larger bear markets are just as dynamic [as declining 'C' waves] and can be mistaken for the start of a new upswing, especially since they unfold in five waves (

section 7.3, number 8). Wave C's are often very similar looking and feeling to wave 3's only that wave C's are part of a larger correction, and often finish that larger correction. According to that description, the rally from August 27, 2010 lows sure feel like a wave C. So that's one of the reasons why I think the above count makes sense.

Above we can see the fibonacci retracement levels (

EWI tutorial secion 8) for wave 2. As a guideline, wave 2's are often quite deep corrections that can easily retrace to the 61% or 78% fibonacci levels which are at the 1150 and 1180 levels. The current environment surely coincides to both a wave C, and a wave 2 to which that wave C lies.

EWI's tutorial states that, "Second waves often retrace so much of wave one that most of the advancement up to that time is eroded away by the time it ends.... At this point, investors are thoroughly convinced that the [bull] market is back to stay (

section 7.2, number 2). Well I don't know about you, but the recent market action, sentiment, and social mood I feel now is that of thinking the resumption of the uptrend that started March of 2009 is now underway. So here two the action the past few weeks also fits farily well with a large wave 2. If so, we just need to wait for this wave C of 2 to complete its subdivisions into a top so we can watch the wave 3 destruction get ahold of this market. If the market continues higher, I think the 1150-1180 could provide so solid resistance.

LESS LIKELY BULLISH ALTERNATE COUNT

Without considering the larger long term wave count or the accompanying mood and momentum behind the current rally, we can just look at a daily chart and see that it's possible that a 3 wave corrective decline occurred from this year's highs, and the rally from the July 1, 2010 lows is the start of an impulse rally to new highs on the year. But when considering the wave personalities I mentioned above with my bearish preferred count along with volume, sentiment and momentum characteristics, this count does not appear likely. But I wanted to show this count so people will at least see the possible bullish potential of this market and can at least be aware of it as we move forward in the coming days/weeks.

To illustrate the overbought momentum I eluded to earlier I wanted to show the daily stochastics for the S&P. You can see that they're well in overbought territory and poised to fall at any time. There are various intraday charts showing oversold and diverging downward behavior as well. As we now well know, these momentum indicators are not good timing methods, but they do show the current momentum potential and possible wave count potential that may coincide with it.

More free technical analysis stuff to take advantage of here as EWI's Senior Tutorial Instructor Jeffrey Kennedy gives you practical lessons -- free.

Lastly, the daily RSI shows it's approaching overbought territory. Of all the momentum indicators out there, I hold the RSI as the most reliable, especially on the daily charts and bigger. On many intraday charts, there's a clear bearish divergence occurring suggesting that the move is overextended, and the longer the divergence remains in place, the sharper and harder the market should fall. Looking at the daily chart we don't see a divergence, but we do see an approach into overbought territory. If the market can actually make the RSI get above the overbought level, and price is not close to making a new high on the year, then I would take that as another bearish sign for the market. So I'll be tracking this one closely.

If your'e interested in learning more basic technical analysis methods, check out the free

Ultimate Technical Analysis Handbook.

The market was quite strong today and closed near its highs so there may be continuation tomorrow. The key now is to look for a sharp intraday reversal in the market, preferably near key levels like the 1150 or 1180 fibo levels I mentioned earlier, along with a nice increase in volume. Until then, I remain patient for the market to fall as I continue to endure the pain it's causing to my account.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.