Well it was a killer day for me in the markets as I did not lose a single trade, both in futures and options trading. I love this volatility, and it is unusual to get this in the summer. Albeit, it took a major event in England to do it, it was still a pleasant surprise and I'm going to have a nice weekend with the profits.

The S&Ps dropped about 30 points from my post this morning and did not reach my projection of 2000 by the end of the day, which means the bears will be back in charge early next week. Remember, the S&Ps were down 110 points in the Globex session and once the US session started, a tone of buying entered the market pushing the index up from about 75 points down, to around 45 points down. So 30 S&P points were bought up in the early US session, and when you add the other 35 points bought up in the late Globex session, there was a ton of buying power used up early this morning. So, how much more bulls are left? And how many bulls still have enough buying power, and feel comfortable using that buying power, going into next week. I will argue - not many. So, expect lower levels early next week and watch the S&Ps drop to 2000, then to possibly 1980, and perhaps even lower than that.

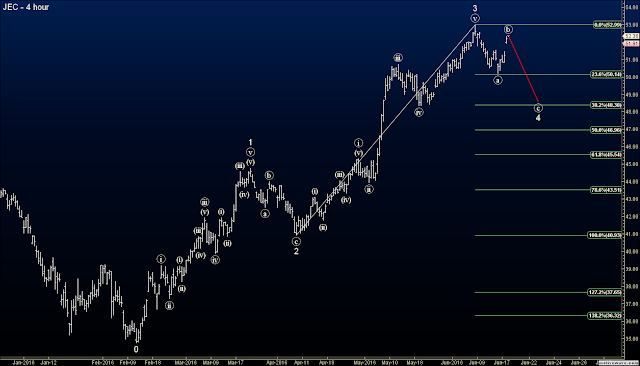

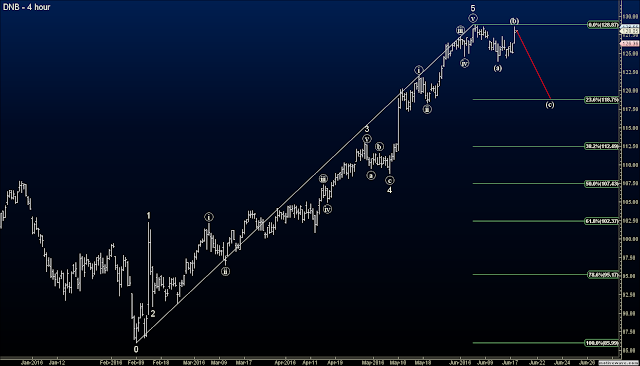

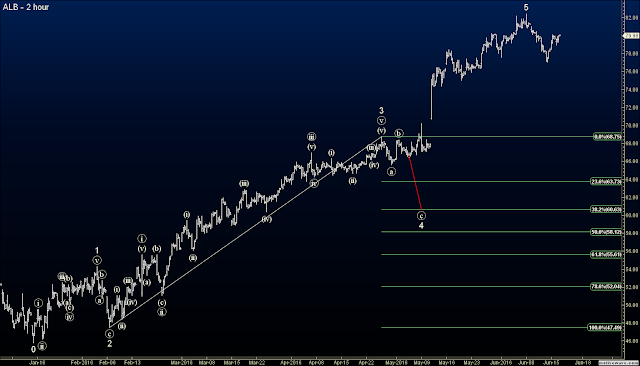

You can check out my 4hr chart I posted from this morning to see the bigger picture, and then check out my chart above with a 10min chart and wave count to break down the analysis with greater detail. You can see from this 10min chart wave count that the S&Ps have a lot of bearish potential. But don't overthink it and try to get this decline narrowed down to a mathematical certainty. Just note that the bottom line is that the market is very bearish right now, surprises will be to the downside, and the bulls have a lot of work to prove they are back in charge.

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.