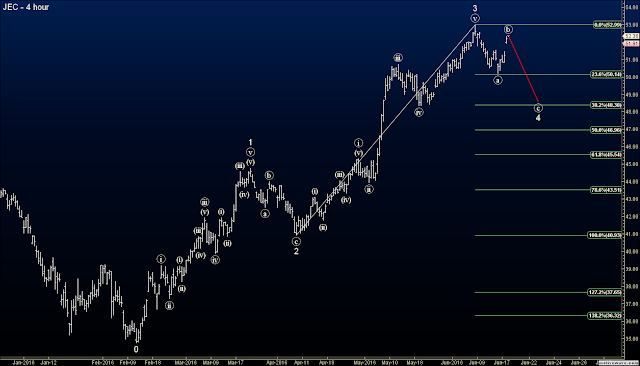

Jacobs Engineering Corp (JEC) has been on a monster rally the past few months. The wave count and my custom indicators suggest a pullback here is warranted, and the put spread is profit target is desirable. Wave ((c)) should take hold soon and drop the stock to the $48 area. So I went short with the following trade:

Buy to open JEC Aug 19 47.5/52.5 put vertical at $1.58

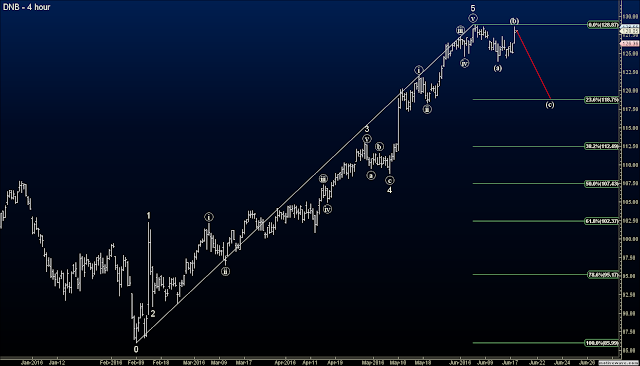

Dun and Bradstreet Corp. (DNB) has also been on a monster rally the past few months. However, my custom indicators fired off a short confirmation signal, and the wave count suggests a Minor degree 5 wave move has completed. Wave (c) is probably about to take hold within what will probably be a wave ((w)) in a combination correction. The wave (c) drop should pull the stock to around $118.75. Here is the trade:

Buy to open DNB Aug 19 115/130 put vertical at $4.68

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.

No comments:

Post a Comment