This Elliott Wave blog is dedicated to sharing Fibonacci ratios and other technical analysis for forex signals, index futures signals, options signals, and stock signals. Elliott Wave Principle puts forth that people move in predictive patterns, called waves. Identify the wave counts, and you can predict the market.

Friday, July 31, 2015

S&P Futures Detailed Count

This is just another way to count the wave ((ii)) correction. Although, the result is still the same as the chart I just posted a few minutes ago.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S&P Futures 1hr

S&P futures are grinding higher but doing so on declining momentum as seen by the bearish divergence on the RSI. It's now flirting with the 78% retracement, which is not uncommon for second waves to do, they tend to be sharp and deep affairs. However, that's the maximum allowable area I'll give it. The bears will need to wake up and attack this market early next week for this wave count to remain on track.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Thursday, July 30, 2015

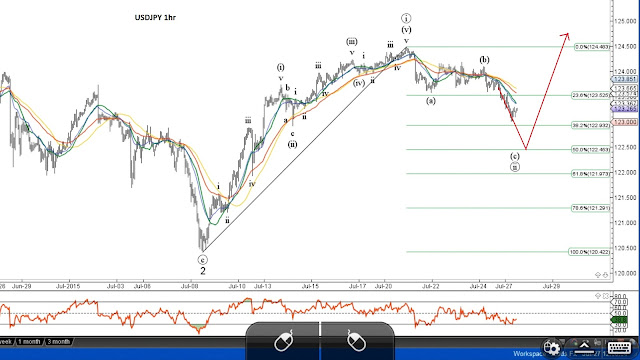

USDJPY 1hr

USDJPY appears to have bottomed and ahead of my expected retracement level and pushed higher. I'm looking for a target of where wave ((i)) = wave ((iii)) Fibo extension at around 127.07.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

EURUSD Daily

The euro continues to grind lower with lower lows and lower highs and staying under the moving averages. As long as that continues I favor the downside with an initial target of 1.0388.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Wednesday, July 29, 2015

S&P Futures 1hr

S&P futures pushed up to the projected 61% Fibonacci retracement level and has stalled so far. Looking for topping and reversal behavior to get short.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Tuesday, July 28, 2015

S&P Futures 1hr Chart

Just getting a closer look at the S&P futures with a 1hr chart. There's a fairly clean impulsive decline finishing its 5th wave with bullish RSI divergence for confirmation. From there we have a clean 3 wave rise. The rally is very indicative of a wave ((ii)) since 2nd waves tend to be very sharp. It has also poked above the previous 4th wave, so this correction may be about complete by now. I'm looking for some reversal action and eventually confirmation with a move below 2061.50.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

EURUSD Daily

The EURUSD has worked lower but has now bounced and is tangled up in the moving averages. I believe it's just a correction that will end soon and give way to my wave (3) target level of 1.0388 which is the 161% extension of wave (1).

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

USDJPY

The USDJPY chart shows a strong move, correlated with the S&P rally, that has bree hed the moving averages and got my attention. The pair is now testing the support side of the moving averages so the behavior from here will be important to determine if wave ((ii)) is complete or not.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S&P Futures

The S&P should have completed wave ((i)) with wave ((ii)) underway. His market is vulnerable to lower levels until 2034.75 is taken out.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Monday, July 27, 2015

USDJPY Update

Quick update on my USDJPY post last night. Prices have pulled back, with the S&P, nicely towards the 50% Fibo retracement level as projected. I still think there is more room to the downside for this pair towards at least the 122.45 area. you can also watch the action in the S&P for a potential bottom for queues on this pair as well.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S&P Futures Headed Lower in Coming Days

S&P futures are headed into a major top, but still have some work to do to get there. The daily count suggests some pullback before resuming the uptrend on one final push. I count a C wave down in the works now, but with the way the S&Ps have traded lately in a choppy mess, I doubt it will unfold in a clear 5 wave decline like I have labeled. The key is to look for something that resembles a C wave whether a clear impulse or perhaps a diagonal. Regardless, look for lower levels and a breech below 2034.50 before bouncing and resuming its uptrend. However, short term, it's oversold so a short term rally may occur.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Sunday, July 26, 2015

EURUSD Downside Target Levels

I just wanted to follow-up on my EURUSD analysis and prepare for possible lower levels this week. Under the current count, the EURUSD is set to fall sharply in a wave (3). If so, a likely target will be the 161% Fibo of Wave (1) at 1.0388. Fibo extensions, which are likely in third waves, continue to the 1.0140 and 0.9740 levels.

I'll update the short term action as it unfolds, and readjust the count as warranted.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

USDJPY May See Pull Back Before Continuing Higher

With the EURUSD possibly resuming its downtrend I'm looking for other pairs to capitalize on the return of dollar strength. The USDJPY has a strong impulsive rise on the hourly chart from 120.42, but really struggled for new highs once it reached 123.73. The new highs from that level were hard fought choppy grinds with a bearishly divergent RSI. I believe the current downward consolidation is an (a) and (b) wave, which sets up nicely with the price action I just described. That type of price action usually results in a sharp retracement. That "sharp retracement" will fit nicely with a wave (c), and therefore ending wave ((ii)).

For now, I'm looking for a move down to the 50% Fibonacci retracement level at 120.45. Price behavior around that area will give us a clue as to how it will progress from there. Over the next several hours, price should continue to close at or beneath the moving averages I have on my chart.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Subscribe to:

Comments (Atom)