I almost missed this important event, but I heard Pete Najarian on CNBC's Fast Money mention the VIX and that it was down and I nearly fell of my chair. In the morning the VIX had rallied from the almost 4% drop to a new yearly low on Thursday and since the market continued with weakness into the close I made the mistake of assuming the VIX was up; WRONG. The VIX dropped another 1.3% Friday, despite the market falling fairly hard all day. This means that people were buying a lot more call options than put options on a fairly solid down day, and in doing so they pushed the VIX to the most complacent level it's been in all year.

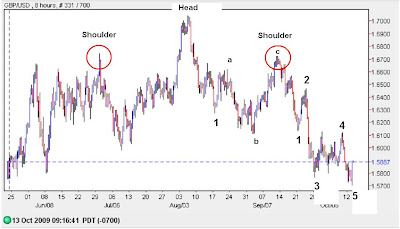

This is big. This shows such a high level of complacency and optimism toward the market that it warns of a possible top in place RIGHT NOW. When you add the 5 wave decline in the futures and other data I mentioned in previous recent posts, it tells us that THE top might actually have just snuck up on us and be in place right now.

BE ON HIGH ALERT FOR A MAJOR TOP IN THE STOCK MARKET. THE VIX COMPLACENCY AND THE 5 WAVE DECLINES ARE HUGE WARNING SIGNS.