This Elliott Wave blog is dedicated to sharing Fibonacci ratios and other technical analysis for forex signals, index futures signals, options signals, and stock signals. Elliott Wave Principle puts forth that people move in predictive patterns, called waves. Identify the wave counts, and you can predict the market.

Thursday, March 17, 2011

Stock Rally Looks Corrective, Downtrend Still Intact; Euro Finishing Triangle

Looking at the internals of today’s action it helps me answer the question I had all day: was today’s rally a correction within a larger downtrend, or did a bottom just get put in and a rally to new highs on the year coming? Looking at the internals it’s clear that today’s action fits much more with a correction than a bottom and reversal. Today’s volume was 1.04 billion NYSE shares compared to yesterday’s down day volume of 1.13 billion shares, and Tuesday’s 1.28 billion shares suggesting much less enthusiasm to the upside than downside. Also, today only had 1,392 more advancers than decliners on the NYSE and 316 more on the S&P, which are much less numbers than we’ve seen on down days the past few weeks. So these are not stellar numbers for such a big rally after a downtrend that’s lasted several weeks. Also note that the Nasdaq Composite closed with only about half of the percentage gains as the S&P and Dow indices. I know Japan is playing a big role in tech’s lagging here, but just looking at this from a technical analysis standpoint, the technology sector’s lagging is often viewed as bearish since higher risk stocks often lead the overall market (note that the Nasdaq 100 which is all technology stocks fared a little better than the Composite at 1.01% gains today).

So looking at these internals now, today’s rally is probably just a correction, and that a resumption of the downtrend to new lows is imminent. Of course, that may change with robust internals tomorrow or later on, but as it stands right now the larger downtrend is still well intact. The bulls took down no key levels, nor did it break the downtrend in price action, and the internals today were far from stellar.

Get Bob Prechter's Latest Elliott Wave Theorist Letter Free!

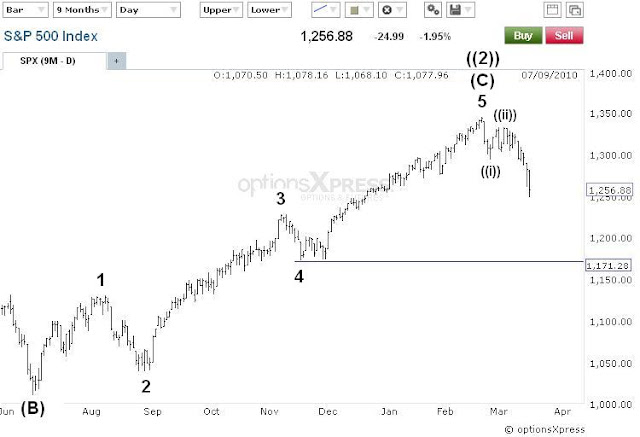

The S&P chart above shows that despite the big rally today, the series of lower highs and lower lows remains intact on even the 30min chart. It’s a good sign for the bears, but not a requirement for success. As long as the Minute wave ((i)) low of 1294.25 remains intact then I’m firmly bearish stocks.

Elliott Wave International's Commodity Freeweek!

On a minor note, I wanted to point out that the Nasdaq Composite (and NDX) did not participate in the late day rally that the S&P and Dow embarked on. You can see that it remained quite flat while the S&P surged higher on the above chart. Now I know the Japan crisis is leaning harder on tech stocks than others, but taking this at face value it MAY be a very subtle signal that more selling pressure is coming sooner than we think. We’ll see tomorrow if this little divergence turns into something much bigger.

The euro has continued its rally, as well as kicking me in the pants, as I was stopped out again last night on my short trade. I see no signs of a top right now so I’m neutral in the short term. It appears a triangle might be forming now as part of a 4th wave. So a sharp thrust higher to a new high and then reversal would then be in order in the Asian and European sessions tonight. Doing so might signal a longer term top and reversal, so I’ll be watching the action closely tomorrow morning to try and attempt another short position. Since I’m long term bearish the euro, I’m only looking for shorting opportunities right now.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Wednesday, March 16, 2011

Stocks Continue to Trend Down, no End in Sight Yet; Euro Poised for Big Decline

EWI's FreeWeek is Here! Get full FREE access to Elliott Wave International's most popular commodity forecasting service

The magnitude of this 3rd wave has called for me to adjust the degrees of trend I’ve been labeling as the 1st and 2nd waves. Now I have a more appropriate Minute waves ((i)) and ((ii)) down from the February high. At this point, we have enough selling and profits on the short side to just take a step back and focus on the bigger picture here in my view. So I’m not interested in counting every little sub-wave within this wave count at the moment. The important key to take home from this is that a 3rd wave is underway, internals are supportive of momentum still on the bears’ side, and the series of lower highs and lower lows remains intact. So the trend is firmly down and the short side is still the path of least resistance.

Support doesn’t really begin until 1225, but this market should move close to the 1170-1185 area before even thinking about forming any significant bottom. The area of the prior 4th wave tends to be a good area to find good reversal points. That area is still a ways away.

Learn Elliott Wave Principle

Above is a close up of the price action and wave count. I’m merely showing this because as it stands now, this chart looks extremely bearish and suggests a large almost straight line down move could be coming at any time. This rolling-over structure is often what precedes major sell offs. So be ready.

The euro’s 1 hour chart appears to have signaled a reversal so far. Amazingly, despite two new major swing highs at this very deep Minute wave ((ii)) retracement, it still has not exceeded the high put in earlier this month. Now we currently have a double top formation, and lots of selling pressure capping the market’s rallies at the moment as you can see from this afternoon’s big spike and reversal. Also notice that the RSI is lagging badly, diverging from the last few highs that price has made.

The evidence is strong that the euro is at the forefront of a major decline here. I’m short again the euro and will stop out if a new high on the month is made.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Tuesday, March 15, 2011

Stocks Should Continue Lower; Euro Still Searching for a Top

My thoughts and prayers are with our Japanese friends across the sea, and with those who have family and friends affected by the disaster there. It’s such a sad and tragic event. Growing up in southern California I’ve been through several earthquakes and the biggest was a 6.0 magnitude that I was literally right on the epicenter of. It was insane. Sitting in my house felt like sitting in the back of an old small beatup pickup truck driving 50 miles an hour over thousands of speed bumps. Our house had separated from the hillside it was on and soon determined to be uninhabitable by the authorities, so it was completely torn down, along with around 30% of my neighborhood. I can’t begin to imagine being even remotely near an 8.9 magnitude quake, then getting hit with a tsunami right after. Tragic.

As for the markets, in yesterday’s post I said:

“Tomorrow [Tuesday] will be a key day as more traders will be at their desks and hitting the go-buttons. Below I mention the bears' breaking point to the upside, so the bears need to see that level hold and volume increase on moves to the downside if a larger downtrend is fact underway. …Watch for volume in conjunction with the price action.”

I wanted to focus on price action and volume because volume was tame on Monday with a whacky indecisive move in price which is usually followed up by a breakout on strong volume. The direction of that breakout should determine the short/medium term trend. Today you can see that we in fact did have strong volume on today’s decline at 1.28 billion NYSE shares. Advancers vs. decliners and up/down volume was not jaw dropping like I’d expect from a 3rd wave at various degrees, but the late day rally probably skewed those numbers a bit into the close for the bulls. Although the wave count in the S&P is not perfect, all signs point to lower levels ahead. I believe the buy-the-dip crowd is assuming the Japanese catastrophe and Libya unrest are only temporary speed bumps in a very healthy bull market, and are buying now for long term investments. This buying power is preventing a capitulation, or washout, which usually causes the market to bottom. So ironically, the buy-the-dip crowd might actually be facilitating and lengthening the decline. So today’s late day rally doesn’t concern me at all.

Get Bob Prechter’s Latest Elliott Wave Theorist Free Until March 21, 2011

The above count remains on track although far from ideal. And with the series of lower highs and lower lows being the trend right now, I’d stay short this market. Needless to say I’d really like to see all the recent swing highs remain intact until we get a nice clear 5 wave impulsive decline on the table. But ultimately 1325.74 remains the breaking point for the bears. Prices must stay below that level in my opinion if the bears want any chance of controlling this market longer term. There are several gaps left open the past few days so we’ll have to watch those when a sizeable bounce occurs. Every day for the rest of the week is a “POMO day” so there might be some buying power entering the markets midday. But without a solid rally with explosively bullish internals, I would treat any rally as a shorting opportunity. As long as 1325.74 remains intact, expect lower levels in stocks for the foreseeable future.

Learn Elliott Wave Principle

The euro made a new therefore negating the call for a top with an impulsive 5 wave decline. However the hourly chart shows a candlestick reversal pattern after making its new high. This is too short of a time for me as a swing trader, but for short term aggressive traders I see this as a short term short trade with a stop just above today's high as a good risk/reward trade. I'll be waiting for a 5 wave decline or a similar reversal pattern on the 4hr charts or bigger.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

As for the markets, in yesterday’s post I said:

“Tomorrow [Tuesday] will be a key day as more traders will be at their desks and hitting the go-buttons. Below I mention the bears' breaking point to the upside, so the bears need to see that level hold and volume increase on moves to the downside if a larger downtrend is fact underway. …Watch for volume in conjunction with the price action.”

I wanted to focus on price action and volume because volume was tame on Monday with a whacky indecisive move in price which is usually followed up by a breakout on strong volume. The direction of that breakout should determine the short/medium term trend. Today you can see that we in fact did have strong volume on today’s decline at 1.28 billion NYSE shares. Advancers vs. decliners and up/down volume was not jaw dropping like I’d expect from a 3rd wave at various degrees, but the late day rally probably skewed those numbers a bit into the close for the bulls. Although the wave count in the S&P is not perfect, all signs point to lower levels ahead. I believe the buy-the-dip crowd is assuming the Japanese catastrophe and Libya unrest are only temporary speed bumps in a very healthy bull market, and are buying now for long term investments. This buying power is preventing a capitulation, or washout, which usually causes the market to bottom. So ironically, the buy-the-dip crowd might actually be facilitating and lengthening the decline. So today’s late day rally doesn’t concern me at all.

Get Bob Prechter’s Latest Elliott Wave Theorist Free Until March 21, 2011

The above count remains on track although far from ideal. And with the series of lower highs and lower lows being the trend right now, I’d stay short this market. Needless to say I’d really like to see all the recent swing highs remain intact until we get a nice clear 5 wave impulsive decline on the table. But ultimately 1325.74 remains the breaking point for the bears. Prices must stay below that level in my opinion if the bears want any chance of controlling this market longer term. There are several gaps left open the past few days so we’ll have to watch those when a sizeable bounce occurs. Every day for the rest of the week is a “POMO day” so there might be some buying power entering the markets midday. But without a solid rally with explosively bullish internals, I would treat any rally as a shorting opportunity. As long as 1325.74 remains intact, expect lower levels in stocks for the foreseeable future.

Learn Elliott Wave Principle

The euro made a new therefore negating the call for a top with an impulsive 5 wave decline. However the hourly chart shows a candlestick reversal pattern after making its new high. This is too short of a time for me as a swing trader, but for short term aggressive traders I see this as a short term short trade with a stop just above today's high as a good risk/reward trade. I'll be waiting for a 5 wave decline or a similar reversal pattern on the 4hr charts or bigger.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Monday, March 14, 2011

Stocks Stair-Step Lower; Euro Surges but Remains Short of New High

Internals today show medium bearish momentum behind the move today. The ups and downs are really quite normal in comparison to the price action today, but the key number here is volume. On the NYSE, only 963 million shares were traded. So although today's price action and internals were firmly bearish, there wasn't much consensus internally for the moves today. So tomorrow will be a key day as more traders will be at their desks and hitting the go-buttons. Below I mention the bears' breaking point to the upside, so the bears need to see that level hold and volume increase on moves to the downside if a larger downtrend is fact underway.

As for the short term, with a series of lower highers and lower lows on the table so far, I'm short term bearish this market. But without clear and definitive impulsive declines it's hard to get too excited in the medium and long term as a bear. Hopefully we'll get some clarity tomorrow. Watch for volume in conjunction with the price action.

Learn Elliott Wave Principle

The wave b triangle that was left on the table Friday is now so unlikely that it's practically eliminated from contention. That leaves the aggressively bearish count as top choice. With the series of lower highs and lower lows in place, it's possible this count represents that a series of several 1 and 2 waves are unfolding at varying degrees. If so, 1325.74 needs to remain intact for that scenario to unfold, so I remain bearish as long as the S&P stays below that level. Ideally, the market should rally little from here. At this point with all the choppy movement with a downward bias, the bears would ideally like to see a sharp move lower to resolve these proposed 1 and 2 waves at various degrees with a sharp downward 3rd wave. I know that may sound confusing, but the bottom line is that a sharp move down on strong volume real soon would put the longer term bearish wave count in a strong position.

Big Advantages of Trading with the Wave Principle

The euro has rallied much more than expected. If the euro has started a downtrend from the March 7th high, then 1.4029 obviously must remain intact. But with the euro so close to that level it's tough to be confident it will hold. That doesn't mean I'll turn bullish if the level is exceeded. I'm long term bearish the euro so I'll be looking for shorting opportunities only. If 1.4029 is broken I'll sit on the sidelines until signs of another top present themselves.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Subscribe to:

Comments (Atom)