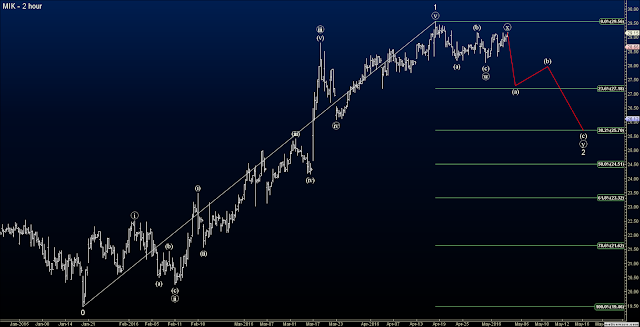

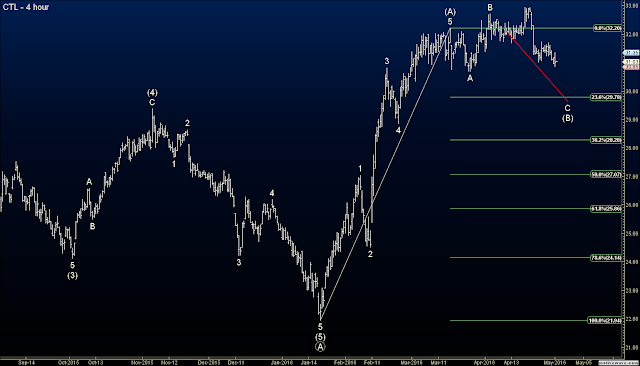

I am a bit unclear on the S&Ps as they do not have a nice wave count and price structure that fit well with my wave count to be honest. I do feel in the short term, the market still has some pullback to do, perhaps to the 38% or 50% Fibonacci retracement levels before launching to the upside again. There is still a large disparity between bearish signals and bullish signals in the market based on my custom indicators, with 92 stocks bearish and only 3 stocks bullish. So I don't think the bearish pressure has been alleviated yet, so I still think there's room to the downside. And if you want to keep it simple, the series of lower lows and lower highs the past couple weeks remains intact. Until that is broken, we should be looking for lower levels in the short term.

One note: Friday, the stock market closed very bearish according to my custom indicators, despite a strong bullish move at the end of the day. There is heavy bearish pressure on the market, despite such a modest rally, and I feel that will resolve itself on Monday with a sharp shot lower fairly early on.

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.