This Elliott Wave blog is dedicated to sharing Fibonacci ratios and other technical analysis for forex signals, index futures signals, options signals, and stock signals. Elliott Wave Principle puts forth that people move in predictive patterns, called waves. Identify the wave counts, and you can predict the market.

Saturday, December 12, 2015

S&P in Wave C Down

Looks like wave C is finally getting underway and has plenty of room to the downside. Many of my momentum indicators on the 4hr and Daily charts are firmly down. However, on a short term basis, 30min charts, the market is oversold. The structure of the decline suggests further levels will be achieved before any meaningful bounce occurs so my bias remains bearish.

I drew some fibonnacci retracement levels for the move up from ((x)) to B to get an idea of where the market may pause and bounce. I'm looking for around the 78% level at 1914 to conclude wave ((iii)), but 3rd waves can extend well beyond what's expected so by no means am I trying to get long there. It's just an area I'll look to take some profits and perhaps lighten up some risk.

The trend remains firmly down as long 2090 is not broken, but preferably I'd like to see 2055 remain intact to keep the series of lower highs in place.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Thursday, November 26, 2015

GBPAUD Long (Forex)

If you look at the daily GBPAUD chart it is clear that the pair is in a solid uptrend. The grind off the high at the 2.24 area is clearly corrective. Price has formed a nice double bottom and is moving strongly and impulsively higher. I see a clear continued move higher in this pair and like going long since the long term trend is up still. If I'm wrong, look for a top near the confluence of Fibo retracement levels in the 2.1126-2.1518 range. But I feel this pair could still move significantly higher.

When trading this pair, keep in mind it can get very wild so protective stops should be wide and therefore proper position sizing is key to proper risk control. In addition, this cross can get really wide spreads up to 15 pips, so be aware of the time you trade it as the Aussie and London sessions tend have the widest spreads for this pair.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S&P Rally Getting Tired?

It's tough to make a strong case against the S&P rally since it keeps defying all odds and floating higher and higher. But from a technical analysis standpoint, I am skeptical of higher levels at this juncture. The wave count is still consistent with a continued decline towards 1800 before resuming another strong uptrend. This is contrary to seasonal positioning as the "Santa Claus" rally would be getting underway next week and would not support this wave count. So I'm cautious on both sides ending the year and prefer to day trade this market and not swing trade at the moment.

One thing I have been watching is the action of the small caps (Russell 2k) relative to the overall stock market (S&P). Up until a few weeks ago, the small caps were lagging the overall market quite a bit. But recently, the small caps have shot higher and are attempting to close the gap. I think that small caps still lead the way for the overall market as they are a good risk barometer, but still nothing tradeable here, it's just another thing to watch to keep you honest when trading the market.

Also, although the Nasdaq as a whole is keep pace with the S&P, major tech stocks like Amazon, Microsoft and Baidu are showing signs of exhaustion, which could be the early signs of a pullback as well.

Conclusion: I don't like this fractured market behavior and the apparent exhaustion of some major stocks that also can be seen as risk-appetite indicators. In addition, the wave count off the wave A low is very corrective looking with its overlapping waves. However, the market appears that it just wants to move higher regardless and it's tough to try and fight that trend. So I remain cautiously bearish, but am looking for only day trades on market indexes, and also for shorts in individual stocks such as Microsoft, LinkedIn, and Baidu.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Sunday, November 1, 2015

S&Ps Ready to Decline

Needless to say, I've been caught off guard by the extent of this rally and I keep trying to call tops and am getting hammered. I don't see much gas left in the rally tank so I'm here again projecting a top, at least short term. The rally counts nice as two 5 wave moves for rally waves (a) and (c) within ((z)), that should complete a very deep wave B.

I have propriety indicators that are very good at indicating overbought and oversold markets, and when price closes back within the overbought or oversold level, it usually marks at least a short term extreme. Then a reversion to the mean occurs. Friday's bearish close closed back underneath the overbought extreme, so a reversion to the mean of about 70 S&P points is likely to occur. When you add that the decline also confirms severe bearish divergence on various momentum indicators you can make a strong case for a decline of significance starting soon.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Sunday, October 11, 2015

S&P Futures 1hr

This correction higher is going on way too long to keep calling it a wave ((iv)). I simply analyzed and labeled the chart according to a price closing basis, where waves ((iv)) and ((v)) completed several weeks ago, completing Primary wave A. This long choppy slop sideways to up since then is Primary wave B. Which, by the way, should be concluding soon as it is possible to count the final rally higher as an impulse wave from numerous different perspectives.

Primary wave C down should get underway quite soon, perhaps as early as this upcoming week. C waves are 3rd waves, and impulsive, so it should be quite a strong affair downward. I'm looking to add to my short positions on a topping formation and/or strong move down on solid volume.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Friday, September 25, 2015

S&P Futures

Not much to write about as the S&P's have been consolidating sideways for several weeks, waiting for the decline to a new low for wave ((v)) or 5. It's certainly not pretty, but the count remains valid and the sideways chop can break down into a WXY combination correction, with the X wave being a triangle.

I still like the overall bias being down and for the wave ((iii)) low to be broken before any meaningful rally will occur. So I continue looking for shorting opportunities for day trades, and holding short for swing trades.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Friday, September 11, 2015

S&P Futures Triangle Continues

The S&Ps continue to consolidate and wrap up a triangle. Although not ideal, and enough to make an EWP purist pull their hair out, the above triangle patterns are valid. Don't get too caught up in technical rules and guidelines at this point, the important element here is that the market is not rallying impulsively off the lows on the year and it is moving sideways after a large move down. Triangle, or consolidations, are simply pauses in the preceding trend. In this case, the preceding trend was down, and hard. So the market will thrust lower to new lows on the year once this consolidation is over.

Wave E finishes triangles and they are usually the result of a news event. Next week we have CPI, Retail Sales, and some FOMC stuff later in the week. Since it's Friday today, and we're ending the triangle pattern, it's quite possible we'll just chop sideways all day today, and possibly Monday until we get that news event for a sharp pop and then massive reversal lower. But keep in mind, the news event doesn't have to be a scheduled event, it could be anything...something can happen in China, Europe, or also in the US that's unexpected.

The bottom line is that I'm positioning myself for a sharp thrust to new lows on the year, which should occur within a week or two.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Tuesday, September 8, 2015

S&P in Bearish 4th Wave Triangle

Boy was I wrong in calling for immediate selling this morning. It appears there is a 4th wave triangle forming, and should be at an end. The "right looks" fits well with the above count if you compare wave ((ii)) to wave ((iv)) now as they both took up a lot of time. If the count is correct, waves (c) and especially (a) of the triangle cannot be breached (with the exception of overnight trading in futures as there is light volume and I would not use that to negate a triangle.

If the 4th wave triangle is correct, massive selling should get underway tomorrow almost immediately.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Sunday, September 6, 2015

S&P Futures Should Continue Decline this Week

The chart on the left has OHLC bars and the chart on the right just using closing levels. From an EWP standpoint, the sub-components of Minor wave 1 make more sense when analyzed on a closing bases (right chart). But normally, I want to use OHLC bars to analyze wave counts so I'm tracking the short term action on OHLC bars (left).

The market declined as expected on Friday after the jobs numbers came out. The sharp rally in the last few minutes of trading Friday was most likely short covering from folks who did not want to stay short over a long weekend. But I highly doubt it was any meaningful buying . As a result, selling should resume, and do so heavily, on Monday. Because of that, I used the late rally Friday afternoon to get more short. The wave count shows the S&P futures in a wave (iii) of 3 right now which means heavy relentless selling should rule the day in the foreseeable future.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Thursday, September 3, 2015

S&P Futures

The persistence of this rally caught me off guard a bit but fits well as a wave (ii) counter trend move. Several of my intraday indicators show the market overbought here. I'm not sure we'll get a breakdown this morning, but ideally the rally should stall here and perhaps break down 30 minutes prior to the close. The jobs report should then trigger wave (iii) down tomorrow morning. This count remains valid as long as 1992.75 is not broken. Although even if it is, we could still work the 3 wave rally off the wave 1 low as a wave 2 correction. More after the jobs report Friday...

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Wednesday, September 2, 2015

S&P Futures

This wave count using closing points on the 1hr time frame is tracking well. Friday's fractured market, as I pointed out, was a good indication that a top was in place as Monday and Tuesday this week has shown significant weakness. And after two days of heavy selling, the bulls managed only a modest float rally higher. Not good for the bulls. Friday is the big jobs report in the morning, then on to the 3 day Labor Day weekend, so I expect the market to probably float around sideways to slightly up Thursday, then huge moves Friday morning after the jobs report, then volume and volatility should taper off significantly after a few hours of trading as traders take off to enjoy the long weekend.

The wave count suggests a major declining phase is underway and that I should favor the downside for my trades in stocks and their derivatives.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Saturday, August 29, 2015

S&P Futures Setting up for Major Decline

The triangle count I posted earlier got crushed almost immediately after I posted it, lol. But that does not change the bearish count overall. This count makes sense from a practical EWP perspective, but does not from a purist fundamental EWP perspective. The reason is that 2nd waves are usually sharp and deep rallies while 4th waves are usually flat and shallow affairs. This count above is opposite of that as wave (ii) is flat and shallow and wave (iv) is sharp and deep. Although the count does not violated any EWP rules, it does contradict EWP guidelines for wave characteristics. But if I tweak the bars a little, we get a cleaner count in my view...

When using closing lines instead of intra-bars we get a much more ideal wave count. Note that waves ((ii)) and ((iv)) are much more proportionate, and that the sharp rally late last week aligns nicely with 2nd wave characteristics (wave 2). An alternate view of this count would be to replace wave 1 with A, and wave 2 with B. Either way, wave 3 or C down will be impulsive, strong and probably quite deep.

The market action Friday was pretty bad for the bulls. The market was very fractured with varying markets and sectors up with others down most of the day. This type of "fractured" behavior often occurs at tops. That type of behavior doesn't always result in in tops, but most tops do exhibit this type of behavior. If the bulls don't come out strong on Monday and hold the gains throughout the day, I expect this market to resume its decline in wave 3 or C quite soon.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Tuesday, August 25, 2015

S&P Futures

The bears were in full control the last 3 trading days and shaved a huge chunk of capital from the markets. The bears have run out and short covering and "discount" buyers are in control. But make no mistake, the selling craze is not over. There is at least one 5th wave to male new lows before we can even consider if the selloff is over or not. I'm waiting for the bears to regroup and getting ready to go short again since the larger trend is still down.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Monday, August 24, 2015

S&P Futures

Well that bullish triangle I proposed got scrapped quick. The markets are in real trouble. We fell hard and closed in the lows Thursday and Friday, then today the S&Ps were down over 100 points in pre-market. We have been in a topping pattern for several months and so the rubber band has gotten real stretched and it now snapping back. Despite the market continuing lower in the foreseeable future, remember that the largest rallies have occurred in bear markets. So the bears need to be vigilant, use proper money management, and have strict discipline not to let greed over run your trading plan as those rallies will be fierce.

My target for S&P futures is the 1750-1770 area.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Tuesday, August 18, 2015

S&Ps Nearing End of Triangle

The S&Ps should be undergoing a wave E of a 4th wave triangle as it appears my ABC correction forecast fell flat. Wave E's are usually caused by a news event so be in the lookout for big news announcements tomorrow and Thursday. Then, I'll be looking to get long for a sharp strong and fast thrust higher to break out of this triangle.

The consolidation in the S&Ps has been quite extended so I expect a large extended move higher to the 2300-2400 level before topping and completely reversing.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

The consolidation in the S&Ps has been quite extended so I expect a large extended move higher to the 2300-2400 level before topping and completely reversing.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Monday, August 10, 2015

S&P Futures 1hr

The strong rally today threw a wrench in my wave count but if it continues lower almost immediately from current levels then it will remain on track. Short term, the market is overbought so weakness from current levels would not be a surprise.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Sunday, August 9, 2015

EURUSD Daily

The euro continues to grind lower and I expect a strong move lower sometime this week. As long as the series of lower highs and lower lows continues, the short side is favored for trades.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S&P Futures 1hr

The S&P is in a C wave which is impulsive so it should leave a clear 5 waves down. Look for lower levels n the days ahead.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Wednesday, August 5, 2015

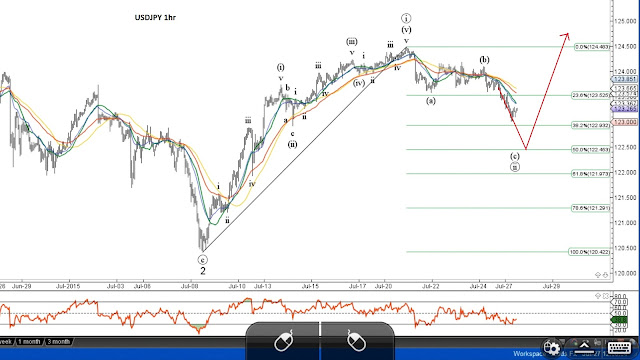

USDJPY 1hr

The USDJPY is finally breaking out of consolidation and moving higher it what could be the start of a bullish 3rd wave. Initial target is the 127 area.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

EURUSD Daily

The Euro is working its way lower and remaining under the moving averages with a steady series of lower lows and lower highs. the trend is firmly down with 1.05 as the initial target.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S$P Futures 1hr

This morning's pop looks like a wave ii and now the bears can regain control, putting the market under heavy pressure the rest of the week.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Tuesday, August 4, 2015

S&P Futures 1hr

S&Ps working lower, albeit slowly. If the wave count above is correct, then prices should move sharply lower tomorrow, and possibly the rest of the week. A push higher above 2110 means that the bulls have probably regained control and will push prices higher for a while.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Monday, August 3, 2015

The wave count is playing out as expected. If correct, this wave count suggests a strong short term downtrend that should last a week or two. The first target is 2056.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Friday, July 31, 2015

S&P Futures Detailed Count

This is just another way to count the wave ((ii)) correction. Although, the result is still the same as the chart I just posted a few minutes ago.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S&P Futures 1hr

S&P futures are grinding higher but doing so on declining momentum as seen by the bearish divergence on the RSI. It's now flirting with the 78% retracement, which is not uncommon for second waves to do, they tend to be sharp and deep affairs. However, that's the maximum allowable area I'll give it. The bears will need to wake up and attack this market early next week for this wave count to remain on track.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Thursday, July 30, 2015

USDJPY 1hr

USDJPY appears to have bottomed and ahead of my expected retracement level and pushed higher. I'm looking for a target of where wave ((i)) = wave ((iii)) Fibo extension at around 127.07.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

EURUSD Daily

The euro continues to grind lower with lower lows and lower highs and staying under the moving averages. As long as that continues I favor the downside with an initial target of 1.0388.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Wednesday, July 29, 2015

S&P Futures 1hr

S&P futures pushed up to the projected 61% Fibonacci retracement level and has stalled so far. Looking for topping and reversal behavior to get short.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Tuesday, July 28, 2015

S&P Futures 1hr Chart

Just getting a closer look at the S&P futures with a 1hr chart. There's a fairly clean impulsive decline finishing its 5th wave with bullish RSI divergence for confirmation. From there we have a clean 3 wave rise. The rally is very indicative of a wave ((ii)) since 2nd waves tend to be very sharp. It has also poked above the previous 4th wave, so this correction may be about complete by now. I'm looking for some reversal action and eventually confirmation with a move below 2061.50.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

EURUSD Daily

The EURUSD has worked lower but has now bounced and is tangled up in the moving averages. I believe it's just a correction that will end soon and give way to my wave (3) target level of 1.0388 which is the 161% extension of wave (1).

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

USDJPY

The USDJPY chart shows a strong move, correlated with the S&P rally, that has bree hed the moving averages and got my attention. The pair is now testing the support side of the moving averages so the behavior from here will be important to determine if wave ((ii)) is complete or not.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S&P Futures

The S&P should have completed wave ((i)) with wave ((ii)) underway. His market is vulnerable to lower levels until 2034.75 is taken out.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Monday, July 27, 2015

USDJPY Update

Quick update on my USDJPY post last night. Prices have pulled back, with the S&P, nicely towards the 50% Fibo retracement level as projected. I still think there is more room to the downside for this pair towards at least the 122.45 area. you can also watch the action in the S&P for a potential bottom for queues on this pair as well.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

S&P Futures Headed Lower in Coming Days

S&P futures are headed into a major top, but still have some work to do to get there. The daily count suggests some pullback before resuming the uptrend on one final push. I count a C wave down in the works now, but with the way the S&Ps have traded lately in a choppy mess, I doubt it will unfold in a clear 5 wave decline like I have labeled. The key is to look for something that resembles a C wave whether a clear impulse or perhaps a diagonal. Regardless, look for lower levels and a breech below 2034.50 before bouncing and resuming its uptrend. However, short term, it's oversold so a short term rally may occur.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Sunday, July 26, 2015

EURUSD Downside Target Levels

I just wanted to follow-up on my EURUSD analysis and prepare for possible lower levels this week. Under the current count, the EURUSD is set to fall sharply in a wave (3). If so, a likely target will be the 161% Fibo of Wave (1) at 1.0388. Fibo extensions, which are likely in third waves, continue to the 1.0140 and 0.9740 levels.

I'll update the short term action as it unfolds, and readjust the count as warranted.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

USDJPY May See Pull Back Before Continuing Higher

With the EURUSD possibly resuming its downtrend I'm looking for other pairs to capitalize on the return of dollar strength. The USDJPY has a strong impulsive rise on the hourly chart from 120.42, but really struggled for new highs once it reached 123.73. The new highs from that level were hard fought choppy grinds with a bearishly divergent RSI. I believe the current downward consolidation is an (a) and (b) wave, which sets up nicely with the price action I just described. That type of price action usually results in a sharp retracement. That "sharp retracement" will fit nicely with a wave (c), and therefore ending wave ((ii)).

For now, I'm looking for a move down to the 50% Fibonacci retracement level at 120.45. Price behavior around that area will give us a clue as to how it will progress from there. Over the next several hours, price should continue to close at or beneath the moving averages I have on my chart.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Friday, July 24, 2015

EURUSD Wave Count

The EUR/USD may have resumed it's downtrend. There's a nice topping formation near the 23% Fibonacci level, and the area of a previous 4th wave (not shown). It's a very shallow correction relative to the preceding decline, but it's a 4th wave and so 4th waves tend to be shallow sideways affairs. So the downtrend may be getting back underway here, especially if it can close to new lows beneath 1.0800. I'd be looking for shorts as long as price stays below 1.1216, but should find some stiff resistance at the moving averages shown on the charts, as well as the 23% Fibonacci level.

Here's a wave count on the hourly chart so you can see how it's unfolding from an intraday level. As long as the series of lower lows and lower highs continues, the trend is down, it's as simple as that as we start the week again.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Friday, July 10, 2015

Getting Long S&P Futures

The market sold off on Yellen's talk about an interest rate hike later this year. We already knew that, so this selloff is nonsense. Internals are strong and I doubt anyone was surprised by Yellen's comments and will want to get heavily short before the weekend. I'm getting long at 2069.

Thursday, July 9, 2015

USDCAD Update

Trade is off the table as the pair shot lower and has now formed an unidentifiable formation. So, no trade.

Wednesday, July 8, 2015

USDCAD Bullish Triangle

Keep it simple everyone. There's a nice clear triangle finishing in the USDCAD. Since triangles are consolidations before a continuation of the previous trend, we know this triangle will result in a sharp move up soon. To make sure it's not a B wave that will thrust lower, I'm looking to get long at 1.2765 with a stop at 1.2740 and taking profit at 1.2790.

Tuesday, June 23, 2015

Dollar Way Overbought

The dollar is way overbought so I'm looking for a pair to surge against the dollar for a short term trade. GBPUSD looks way oversold and set to rally any minute now. I like starting to get long here with stops at 1.5690 and looking for a move to test the 1.5800 level within the next 24 hours.

Wednesday, June 17, 2015

EURUSD Breaking Out of Triangle

The EURUSD is breaking out of a triangle to the upside. Pretty simple longer term trade setup here: long with a stop just below the Fed news spike at 1.1210 and looking to take profits at the 1.1465 area.

Tuesday, June 16, 2015

Holding Off on Dollar Longs

The dollar has not rallied like I expected. Despite .9190 USDCHF holding, the dollar cannot find its legs and sustain a move higher. We are going into a Fed meeting tomorrow so things will get whacky, and according FXCM's Speculative Sentiment Index, retail traders are heavily long the dollar right now. So I do not like being long the dollar right now. But once the Fed is out of the way I will be looking to get long the dollar through AUDUSD GBPUSD shorts and/or USDCHF longs when the setups are right.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Friday, June 12, 2015

Getting Long the Dollar

Last trade resulted in an 81 pip loss so I look to come back with a nice trade now. The dollar is looking very oversold in the short term, and my wave count on the USDCHF has a large impulsive rally for a wave 1, and then a very deep a)) b)) c)) decline. USDCHF should rally AT A MINIMUM her to the 0.9300 area, but according to this wave count, and 2 year support holding well, getting long against 0.9190 for long term or short term setup seems like a good choice here.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Friday, June 5, 2015

EURAUD Set to Fall Hard Soon

I've seen enough on this pair to conclude that it will sell off soon. It is severely overbought short term. As long as 1.4681 holds, then prices are poised to shoot lower very soon. My initial target is at 1.4400, which is over 200 pips away. But risking 70 pips to make 200 in a high probability trade is always desirable.

Plus, the backdrop of EURUSD weakness that seems to be taking hold again, I like getting short the EURAUD as the technical setup and risk/reward is quite favorable out of all the euro pairs.

Thursday, June 4, 2015

USDJPY Trade Good for a Quick 25 Pips

Just a quick follow-up on the USDJPY trade I mentioned this morning. Where it goes from here, I'm not sure, but the rally off the low looks corrective. But I just liked the high probability trade I saw.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

USDJPY to Pull Back Here

I've seen enough to call a top in the USDJPY for a short term trade. We had a nice bullish 4th wave triangle followed by a 5th wave thrust which is so far confirmed by divergence with the RSI. Look for the USDJPY to return to at least the apex of the triangle soon in the 124.30 - 124.40 area at least. There's still a lot of room to the downside after that if you trail your stop.

Wednesday, June 3, 2015

My Personally Developed EA Portfolio is up 1055 Pips and 14.2% on a $1,000 Account

This is a live account where I started my custom EA portfolio April 1, 2015. The MYfxbook tracking starts at the account inception which is misleading since another wild strategy was on the before. You'll notice that since the start of the current portfolio, it is much less volatile with only an 11.3% drawdown and smooth upslope forming. 2.5 months, up over 1000 pips and 14%, not a bad start.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Tuesday, May 19, 2015

AUDUSD 124 Pip Profit

Well that worked out nicely. There was a quick 124 pip drop since my last post calling for a bearish move lower soon. Prices certainly have room to move a bit lower, but support could firm up a bit here and the move lower has been sharp. I'm taking profits here and looking for the next big move.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

Subscribe to:

Posts (Atom)