EWI's FreeWeek is Here! Get full FREE access to Elliott Wave International's most popular commodity forecasting service

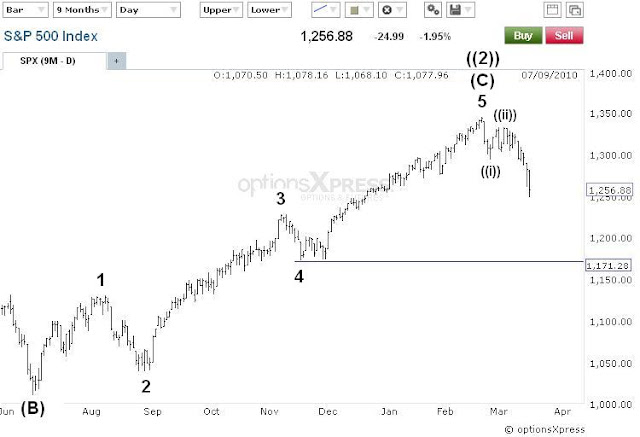

The magnitude of this 3rd wave has called for me to adjust the degrees of trend I’ve been labeling as the 1st and 2nd waves. Now I have a more appropriate Minute waves ((i)) and ((ii)) down from the February high. At this point, we have enough selling and profits on the short side to just take a step back and focus on the bigger picture here in my view. So I’m not interested in counting every little sub-wave within this wave count at the moment. The important key to take home from this is that a 3rd wave is underway, internals are supportive of momentum still on the bears’ side, and the series of lower highs and lower lows remains intact. So the trend is firmly down and the short side is still the path of least resistance.

Support doesn’t really begin until 1225, but this market should move close to the 1170-1185 area before even thinking about forming any significant bottom. The area of the prior 4th wave tends to be a good area to find good reversal points. That area is still a ways away.

Learn Elliott Wave Principle

Above is a close up of the price action and wave count. I’m merely showing this because as it stands now, this chart looks extremely bearish and suggests a large almost straight line down move could be coming at any time. This rolling-over structure is often what precedes major sell offs. So be ready.

The euro’s 1 hour chart appears to have signaled a reversal so far. Amazingly, despite two new major swing highs at this very deep Minute wave ((ii)) retracement, it still has not exceeded the high put in earlier this month. Now we currently have a double top formation, and lots of selling pressure capping the market’s rallies at the moment as you can see from this afternoon’s big spike and reversal. Also notice that the RSI is lagging badly, diverging from the last few highs that price has made.

The evidence is strong that the euro is at the forefront of a major decline here. I’m short again the euro and will stop out if a new high on the month is made.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

No comments:

Post a Comment