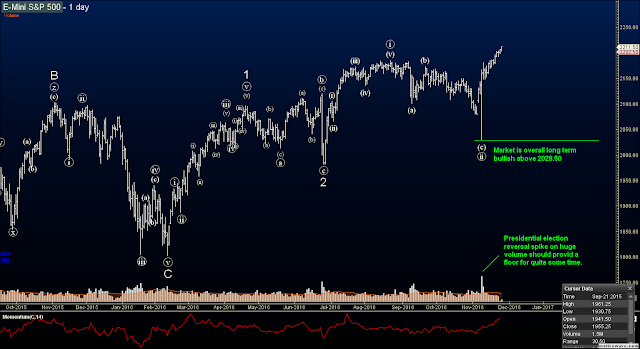

The stock market has been quite a mess the past year or so with with choppy sideways-to-up price action that it has had me on the sidelines for the most part. I have been trying to trade individual stocks through options trades, and focusing on forex as a result. The one thing notable that has occurred recently is the price action surrounding the US presidential election. On election day, the overnight session so a huge drop in the markets when Donald Trump appeared to be the victor. But when the US traders woke up the next day, they quickly bought up the oversold market and carried it to new highs from the previous trading day. This was also done on huge volume of course. So, market players are telling us that although there was initial fear of a Trump victory based on potential instability in the US, once the panic subsided market players saw the Trump win good for the economy and stock market. Whether that is true and will play out, we don't know obviously. But the market is pricing in positive economics and earnings for at least 6 months out.

So we have a huge reversal higher on a giant volume spike from back earlier this month. The low is 2028.50 for that day. To me, that is a key level for the bulls. For the long term, as long as price remains above this level, the market is overall bullish 6 months out from the day you're in. There will be pullbacks along the way, but long term investors would be wise to go long the markets long as that level remains intact.

There are several signs of a short term pullback in stocks across the board, as well in Japanese yen pairs in forex, so I think if buyers are patient they can wait for that pullback to get long some stocks that may be to pricey right now. I am personally getting short the USDJPY and GBPJPY in forex.

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.

1 comment:

Don't have Facebook so just wanted to "like" here in the comments section. Really enjoy reading your periodic posts and thanks for doing so.

Post a Comment