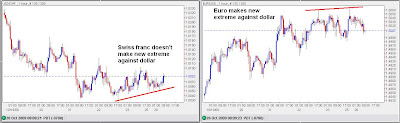

With the rally today in the stock market, the 4th wave bullish triangle I counted on Friday remains intact. All eyes remain on the US dollar for clues of a stock market top (should coincide with a US dollar bottom). Last night the euro made a new high against the dollar but the swiss franc did not (see charts above). Usually these pairs move inverseley to each other quite solidly with a strong negative correlation. When you combine this divergence with the extreme weakness and vulnerability of the british pound to bad news against the dollar, it appears the dollar weakness theme is cracking. It's clear on the 1 hour - 4 hour charts that the dollar decline is really struggling to work lower and severe momentum divergences remain in place along with a viable completed wave count in place, it makes a good case that the dollar bottom may already be at hand. Any break to new lows should be sharp moves that are reversed fairly quickly and will lead to the bottom anyway. So the dollar's downward spiral is ending soon regardless. As I've said before, a dollar bottom should coincide with a stock market top.

No comments:

Post a Comment