Please note that I modified my "Long Term S&P Futures Chart" on the right of this blog. Also a quick clarification, yesterday I said that all the main indices confirmed the Dow's new high, but this was only for the S&P and Nasdaq 100, the Nasdaq Composite dit not make a new high.

I just wanted to drop a note on what I see this morning. There are a few things to take note so far:

1) the internals are fairly weak on the NYSE which has been the trend the past few days. This is important because it shows a lack of confidence in the rally at this point, and also contributes to the "fractured market" thesis I've been talking about in past posts where only a small handfull of stocks are leading the overall market higher.

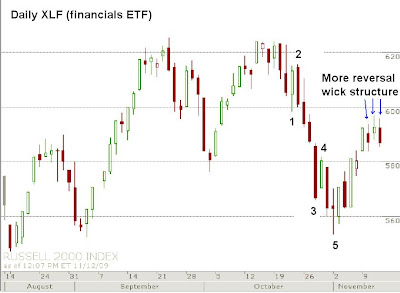

2) the Russell 2000 and the XLF are both well beneath their daily highs and are forming reversal patterns so far. You can see on my attached charts that there is a lot of selling pressure at near current levels by the medium length candle wicks. A strong close beneath yesterday's close would be a good signal that a reversal at some degree has occurred.

3) the dollar is on fire since yesterday. The EUR/USD is considered the "anti-dollar" because it basically moves opposite the US Dollar Index. Because of that, it means the EUR/USD should follow the stock market fairly well, since the stock market has been moving opposite the dollar. The EUR/USD has rallied in 5 waves, but did not make a new daily high, so that's concerning to the short term bearish case for the EUR/USD. However, the decline from its high is quite fast and ferocious so we should pay close attention. A break of 1.4800 will be a good start to calling a major top and reversal, and a break beneath 1.4620 will confirm a EUR/USD top and US dollar bottom is in place for a long time.

So that's what I noticed this morning that was worth announcing. This can all change as the day wears on, but this is what I'm watching at the moment.

More later.

No comments:

Post a Comment