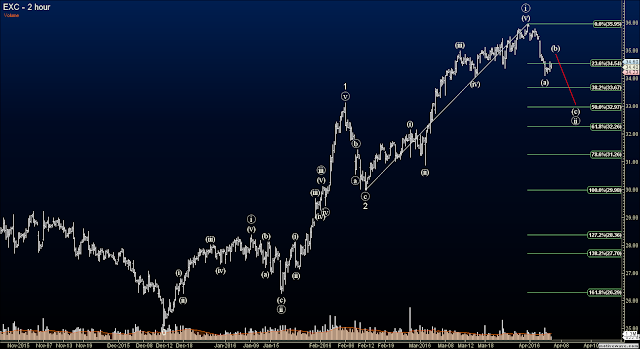

One of the few trades I've had lately that unfolded in a nice clean ABC correction. Price has currently stopped in the middle of two Fibonacci retracement levels and is in 3 waves which tells me this wave (c) may extend lower to perhaps the 61% Fibonacci retracement at $32.26. But it will do so without me as my target level was hit. Here is the trade summary:

Bought EXC put spread May 20 32/35 for $1.08 and sold for $1.53 for a 42% profit.

HERE IS THE ORIGINAL TRADE SETUP:

Exelon Corp. shows a very weak pattern for wave (v) of ((i)) which is similar to an ending diagonal. This type of pattern shows a tiring of the current trend and often results in a sharp reversal. We see the start of that strong reversal with a clean five wave decline in wave (a), and it is now in a wave (b) rally phase before a sharp impulsive move lower gets underway for wave (c) of ((iii)). Here was my trade from two days ago:

Buy to Open EXC May 20 32/35 Put Vertical @ $1.08.

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.

No comments:

Post a Comment