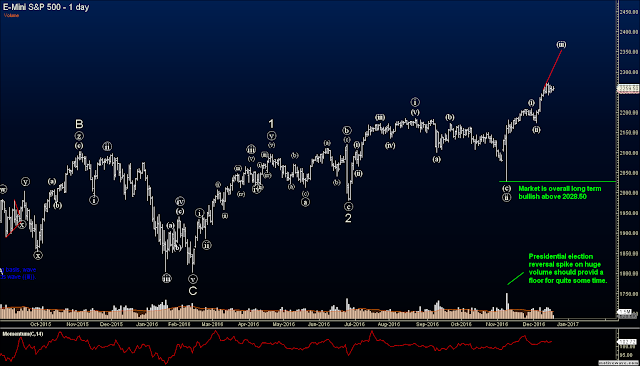

The market has held up well the past week or so and my wave count remains intact. It looks like a fourth wave consolidation is occurring and a shot higher will ensue shortly. I don't see any big action occurring until the New Year, but a steady float higher should occur up until then.

The US Dollar appears overbought, along with all the Japanese yen pairs, so short term selling of the USD and buying of JPY might be wise when a technical setup coincides with those directions. I would remain nimble and flexible with the trades and view them as short term corrective opportunities as they are Fed related moves leading up to this point. Long term, they should continue in their current directions, but short term they are due for a correction.

Here is a snapshot that drills down the wave count a little more from the daily chart. This 4 hour chart shows a strong rally that should continue to the 2400-2450 area before any meaningful correction. There are multiple alternate counts that also conclude at the 2400 level as well, so that level appears be a good place to look for a solid correction.

Please support the blog and like this post :-)

PLEASE NOTE: THIS IS AN ELLIOTT WAVE BLOG EXPRESSING AN OPINION AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. TRADE AT YOUR OWN RISK.

2 comments:

By 2017, I expect EURUSD to fall deeper.

The European currency suffered a legendary blow against the American dollar in 2014.It fell from 1.3967 to 1.2000. That is about 2000 pips fall.It struggled to recover in 2015 and 2016 without making it above 1.1713. That means the recovery was limited below the fibo 38.2% of the 2014 fall.

Looking carefully at the weekly chart, we can see that the pair has recorded another little spike below the 3-year low. If you see what I see now, we do have a bearish flag on the weekly chart above.As such,this shows that there is greater tendency that the pair will make another major low in 2017.Technically speaking, many traders will add to their existing short positions next year until the trend reverses.

Bosun

FxGlory remains my best broker since 2014.

I agree. I see the eur/usd getting into the mid-90's before any possibility of a meaningful correction. Do you have a chart you can share of the weekly flag?

Post a Comment