I'm going to cut back my postings and saturate a few postings per week with the core elements to focus on. Since EWI's Short Term Update comes out Monday, Wednesday and Friday, I will post my core thoughts and charts Tuesday and Thursday to help fill in the gaps that many wavers might feel they have. On Monday, Wednesay, Friday and sometimes Sunday I will post internals data and brief comments on the day's action.

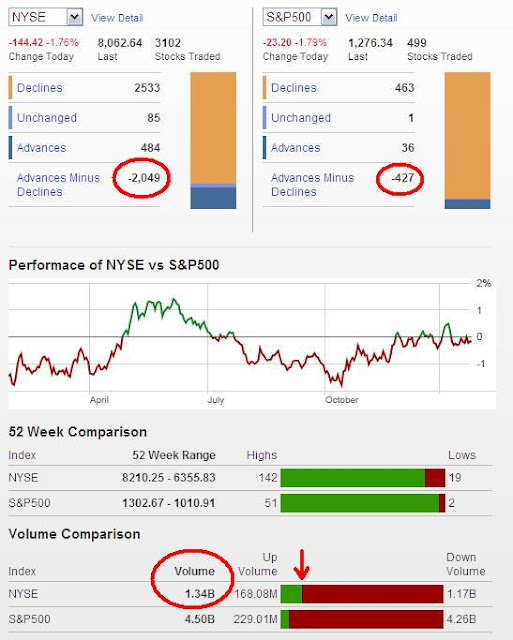

Internals were very weak today as you can see above. There were 2049 more decliners than advancers on the NYSE, down volume was 87.3% of total volume, 463 S&P 500 stocks closed down, and total volume on the day was 1.34 billion NYSE shares, which is quite high for a Friday. All-in-all, it was a very bearish day today and a lot of profit taking, and fear, entered the market today. A solid bear victory no doubt, and it now leaves the doors open for some significant and sustained follow-through. Whether this is just a mild pullback after hitting the round numbers yesterday (Dow 12,000 and S&P 1300), or whether it's the start of the monster Primary wave ((3)) many wavers have been waiting for will take a while to confirm. But the odds are high right now that at least a significant top is in place and another 50-100 S&P points should be taken out in the coming weeks.

Basic Wave Patterns: How a Zigzag Differs from a Flat

Above is my intraday count of what might be transpiring. After Subminuette wave i completed there has been little rallying from the low, and in fact, the market pretty much closed on its lows, another bearish behavior on the day. However, if my count above is correct, then Micro wave ((C)) will give us a sharp rally to around 1290 on Monday-Tuesday before the next selling phase ensues. If so, it would be a great shorting opportunity in my opinion. The other scenario leaves Subminuette wave ii already complete at the Micro wave ((A)) high I have labeled, and Monday will bring about even sharper and deeper selling. I doubt that though. Mondays are usually strong and the buy-the-dip crowd should be back in force after thinking about all the "great values" they can get over the weekend after the declines today. The one thing the bears don't want is a slow choppy grind lower we've called the "wolf wave" in the past. Those are usually corrective and quickly lead to a monsterous rally as a result.

So there's your setup for next week; the trend should be down at least for the short term, and if we're lucky enough to get a solid bounce on Monday then I'd be shorting into it. I expect at least another 50-100 S&P points to be shaved off in quick order if a top is in place right now.

Learn Elliott Wave Principle

The evidence for a top in the euro is strong (bottom in the US dollar). The choppy grind higher clearly looks corrective and is a weak structure suggesting a sharp pullback is at hand. The uptrend has been broken now and I expect the trend for the euro to be down against the dollar in the coming days/weeks. That means I'm bullish the US dollar now. I feel the euro is headed to parity with the USD eventually, so this would represent a great risk/reward opportunity for who feel the same way.

PLEASE NOTE: THIS IS JUST AN ANALYSIS BLOG AND IN NO WAY GUARANTEES OR IMPLIES ANY PROFIT OR GAIN. THE DATA HERE IS MERELY AN EXPRESSED OPINION. TRADE AT YOUR OWN RISK.

1 comment:

Okay, so let's see, the S&P made a new low in March of 2009 (666), and has so far failed to make a new high (1539). In the past 5 years it's up 10% and in the past 10 years it's down 0.08%. Some bull market. My savings account would yield better than that on an annually compounded basis and since it's FDIC insured it's practically a risk-free investment.

.

So the answer to your question is no, I haven't recognized that we're in a bull market. And you shouldn't recognize it as such either.....at least until 1539 is broken.

Post a Comment